Question: Please don't write it on a notebook, prefer typed out Show detailed steps to solve the following questions. You can work with an Excel spreadsheet,

Please don't write it on a notebook, prefer typed out

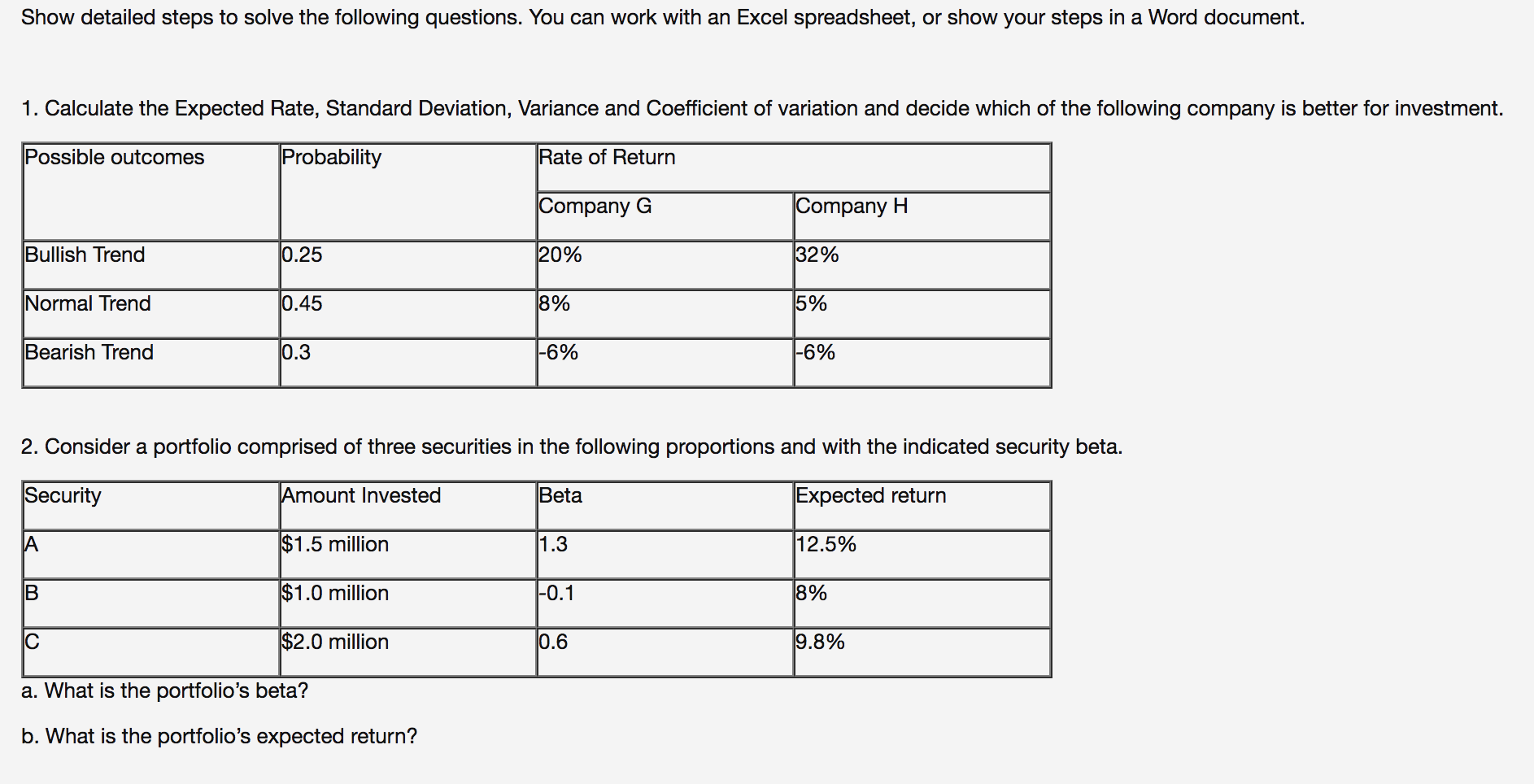

Show detailed steps to solve the following questions. You can work with an Excel spreadsheet, or show your steps in a Word document. 1. Calculate the Expected Rate, Standard Deviation, Variance and Coefficient of variation and decide which of the following company is better for investment. Possible outcomes Probability Rate of Return Company G Company H Bullish Trend 0.25 120% 32% Normal Trend 10.45 8% 5% Bearish Trend 0.3 |-6% |-6% 2. Consider a portfolio comprised of three securities in the following proportions and with the indicated security beta. Security Amount Invested Beta Expected return A $1.5 million 1.3 12.5% B $1.0 million -0.1 18% $2.0 million 0.6 9.8% a. What is the portfolio's beta? b. What is the portfolio's expected return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts