Question: Please double check my work.. 2. Exercise value and option price The value derived from exercising an option immediately is the exercise value. No rational

Please double check my work..

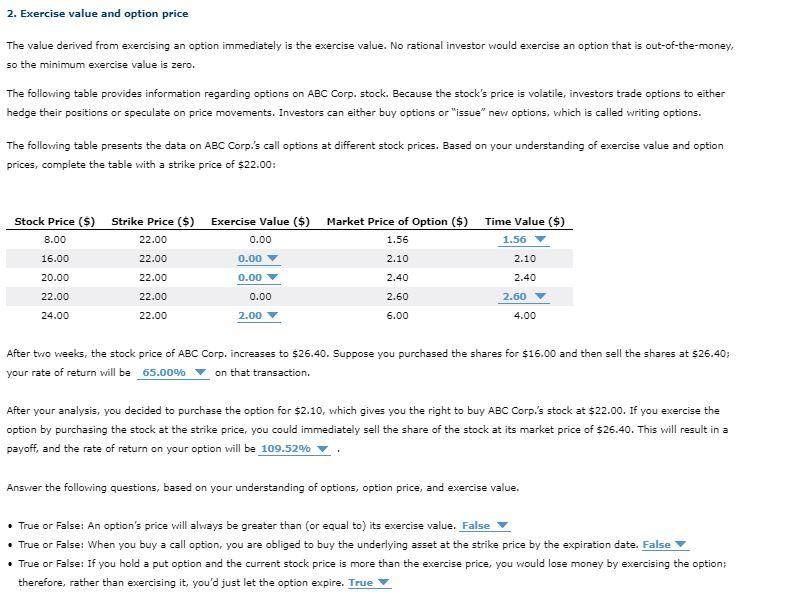

2. Exercise value and option price The value derived from exercising an option immediately is the exercise value. No rational investor would exercise an option that is out-of-the-money, so the minimum exercise value is zero. The following table provides information regarding options on ABC Corp. stock. Because the stock's price is volatile, investors trade options to either hedge their positions or speculate on price movements. Investors can either buy options or "issue" new options, which is called writing options. The following table presents the data on ABC Corp.'s call options at different stock prices. Based on your understanding of exercise value and option prices, complete the table with a strike price of $22.00: Stock Price ($) 8.00 16.00 Strike Price ($) Exercise Value ($) Market Price of Option ($) Time Value ($) 22.00 0.00 1.56 1.56 22.00 0.00 2.10 2.10 22.00 0.00 2.40 2.40 22.00 0.00 2.60 2.60 22.00 2.00 6.00 4.00 20.00 22.00 24.00 After two weeks, the stock price of ABC Corp. increases to $26.40. Suppose you purchased the shares for $16.00 and then sell the shares at $26.40; your rate of return will be 65.00% on that transaction. After your analysis, you decided to purchase the option for $2.10, which gives you the right to buy ABC Corp.'s stock at $22.00. If you exercise the option by purchasing the stock at the strike price, you could immediately sell the share of the stock at its market price of $26.40. This will result in a payoff, and the rate of return on your option will be 109.52% Answer the following questions, based on your understanding of options, option price, and exercise value. . True or False: An option's price will always be greater than (or equal to) its exercise value. False True or False: When you buy a call option, you are obliged to buy the underlying asset at the strike price by the expiration date. False True or False: If you hold a put option and the current stock price is more than the exercise price, you would lose money by exercising the option; therefore, rather than exercising it, you'd just let the option expire. True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts