Question: Please double check my work on this question. Thank you. 31) On November 4, 2014, Blue Company acquired an asset (27.5-year residential real property) for

Please double check my work on this question. Thank you.

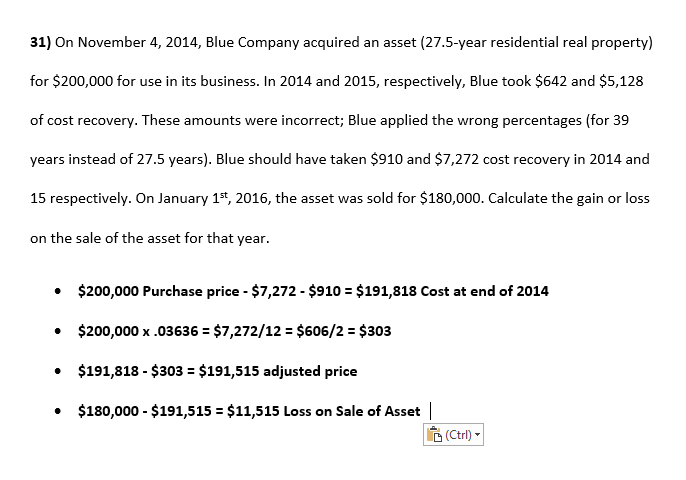

31) On November 4, 2014, Blue Company acquired an asset (27.5-year residential real property) for $200,000 for use in its business. In 2014 and 2015, respectively, Blue took $642 and $5,128 of cost recovery. These amounts were incorrect; Blue applied the wrong percentages (for 39 years instead of 27.5 years). Blue should have taken $910 and $7,272 cost recovery in 2014 and 15 respectively. On January 1st, 2016, the asset was sold for $180,000. Calculate the gain or loss on the sale of the asset for that year. .$200,000 Purchase price- $7,272 - $910- $191,818 Cost at end of 2014 $200,000 x .036362 $7,272/12 = $606/24 $303 .$191,818- $303 -$191,515 adjusted price .$180,000 - $191,515-$11,515 Loss on Sale of Asset (Ctrl)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts