Question: please double check what I did and correct if i have any mistake! thanks The following information is extracted from Shelton Corporation's accounting records at

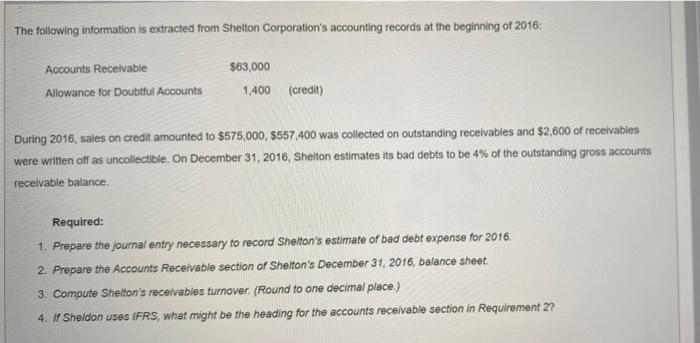

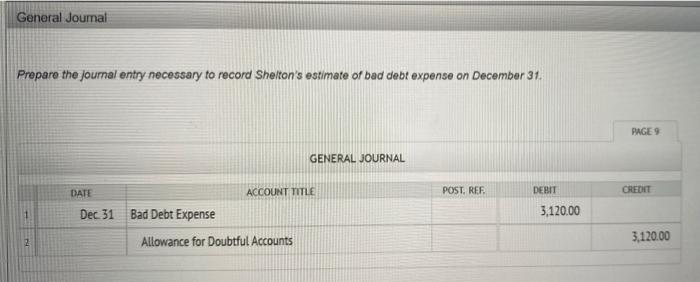

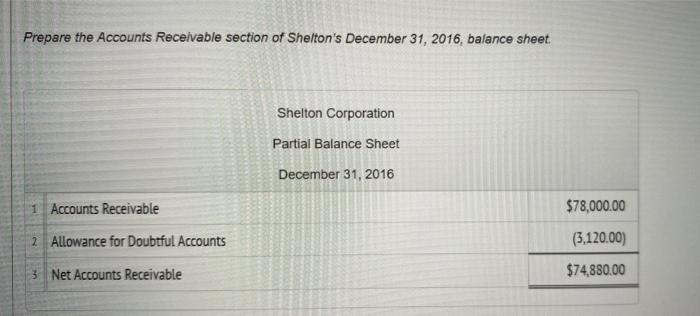

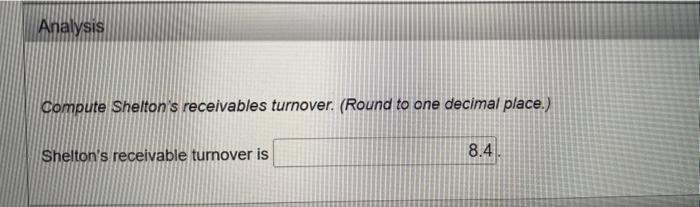

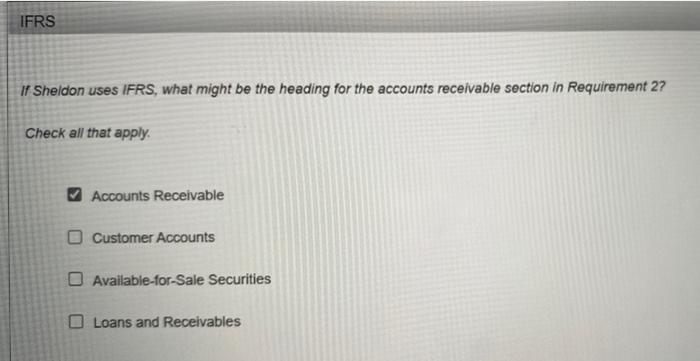

The following information is extracted from Shelton Corporation's accounting records at the beginning of 2016: $63,000 Accounts Receivable Allowance for Doubtful Accounts 1.400 (credit) During 2016, sales on credit amounted to $575,000,$557,400 was collected on outstanding receivables and $2,600 of receivables were written off as uncollectible. On December 31, 2016, Shelton estimates its bad debts to be 4% of the outstanding gross accounts receivable balance. Required: 1. Prepare the journal entry necessary to record Shelton's estimate of bad debt expense for 2016 2. Prepare the Accounts Receivable section of Shelton's December 31, 2016, balance sheet. 3. Compute Shelton's receivables turnover. (Round to one decimal place.) 4. I Sheldon uses IFRS, what might be the heading for the accounts receivable section in Requirement ? General Journal Prepare the journal entry necessary to record Shelton's estimate of bad debt expense on December 31 PAGE 9 GENERAL JOURNAL DATE ACCOUNT TITLE POST, RER DEBIT CREDIT 1 Dec 31 Bad Debt Expense 3,120.00 3.120.00 Allowance for Doubtful Accounts 2 Prepare the Accounts Receivable section of Shelton's December 31, 2016, balance sheet Shelton Corporation Partial Balance Sheet December 31, 2016 1 Accounts Receivable $78,000.00 (3,120.00) 2 Allowance for Doubtful Accounts 3. Net Accounts Receivable $74,880.00 Analysis Compute Shelton's receivables turnover. (Round to one decimal place.) Shelton's receivable turnover is 8.4 IFRS if Sheldon uses IFRS, what might be the heading for the accounts receivable section in Requirement 2? Check all that apply Accounts Receivable Customer Accounts Available for Sale Securities O Loans and Receivables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts