Question: * Please draw out the decision tree diagram for this question Sony sells its 4 K OLED TV primarily in United States. Demand in the

Please draw out the decision tree diagram for this question

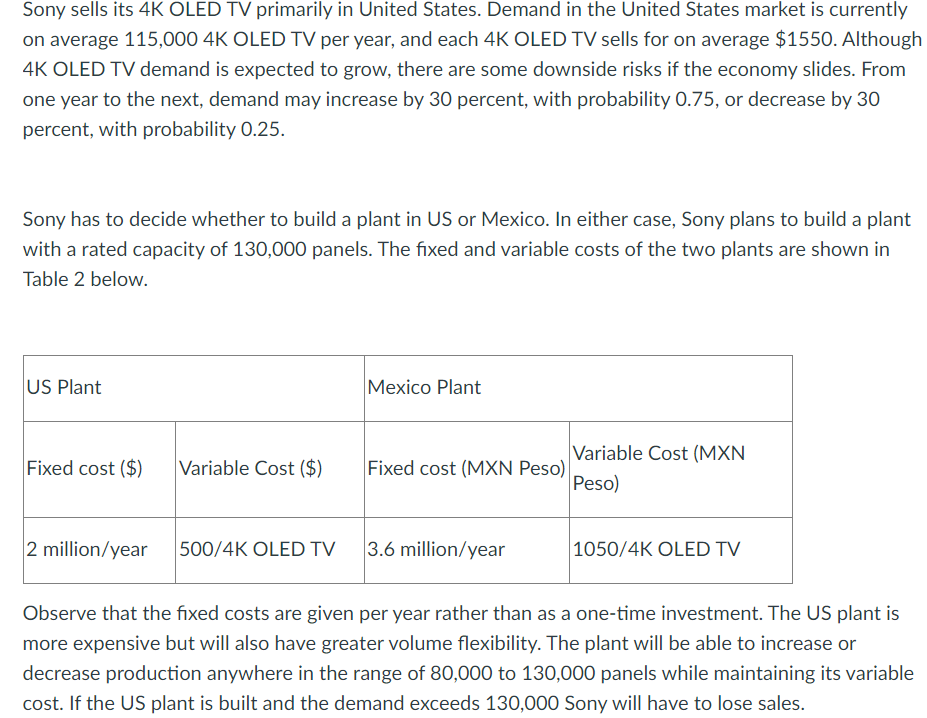

Sony sells its K OLED TV primarily in United States. Demand in the United States market is currently on average K OLED TV per year, and each K OLED TV sells for on average $ Although K OLED TV demand is expected to grow, there are some downside risks if the economy slides. From one year to the next, demand may increase by percent, with probability or decrease by percent, with probability

Sony has to decide whether to build a plant in US or Mexico. In either case, Sony plans to build a plant with a rated capacity of panels. The fixed and variable costs of the two plants are shown in Table below.

US Plant

Mexico Plant

Fixed cost $

Variable Cost $

Fixed cost MXN Peso

Variable Cost MXN Peso

millionyear

K OLED TV

millionyear

K OLED TV

Observe that the fixed costs are given per year rather than as a onetime investment. The US plant is more expensive but will also have greater volume flexibility. The plant will be able to increase or decrease production anywhere in the range of to panels while maintaining its variable cost. If the US plant is built and the demand exceeds Sony will have to lose sales.

In contrast, the Mexican plant is cheaper at the current exchange rate of Peso$ but will have limited volume flexibility and can produce only between and panels. If the Mexican plant is built, Sony will have to incur variable cost for panels even if demand drops below that level and will lose sales if demand increases above panels. Exchange rates are volatile; each year, the MXN Peso is expected to rise percent, with a probability of or drop percent, with a probability of Assuming that the sourcing decision will be in place over the next three years and the discount rate used by Sony is Consider the first year as period and the following two years as periods and

Draw the Decision Tree for this problem.

Sony sells its K OLED TV primarily in United States. Demand in the United States market is currently on average K OLED TV per year, and each K OLED TV sells for on average $ Although K OLED TV demand is expected to grow, there are some downside risks if the economy slides. From one year to the next, demand may increase by percent, with probability or decrease by percent, with probability

Sony has to decide whether to build a plant in US or Mexico. In either case, Sony plans to build a plant with a rated capacity of panels. The fixed and variable costs of the two plants are shown in Table below.

US Plant Mexico Plant Fixed cost $ Variable Cost $ Fixed cost MXN Peso

Variable Cost MXN Peso

millionyear K OLED TV millionyear K OLED TV

Observe that the fixed costs are given per year rather than as a onetime investment. The US plant is more expensive but will also have greater volume flexibility. The plant will be able to increase or decrease production anywhere in the range of to panels while maintaining its variable cost. If the US plant is built and the demand exceeds Sony will have to lose sales.

In contrast, the Mexican plant is cheaper at the current exchange rate of Peso$ but will have

limited volume flexibility and can produce only between and panels. If the Mexican

plant is built, Sony will have to incur variable cost for panels even if demand drops below that

level and will lose sales if demand increases above panels. Exchange rates are volatile; each

year, the MXN Peso is expected to rise percent, with a probability of or drop percent, with a

probability of Assuming that the sourcing decision will be in place over the next three years and

the discount rate used by Sony is Consider the first year as period and the following two years

as periods and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock