Question: Please email me an Excel file with 6-sheets, one each for each of the following 6 problems and n that order and name the sheets

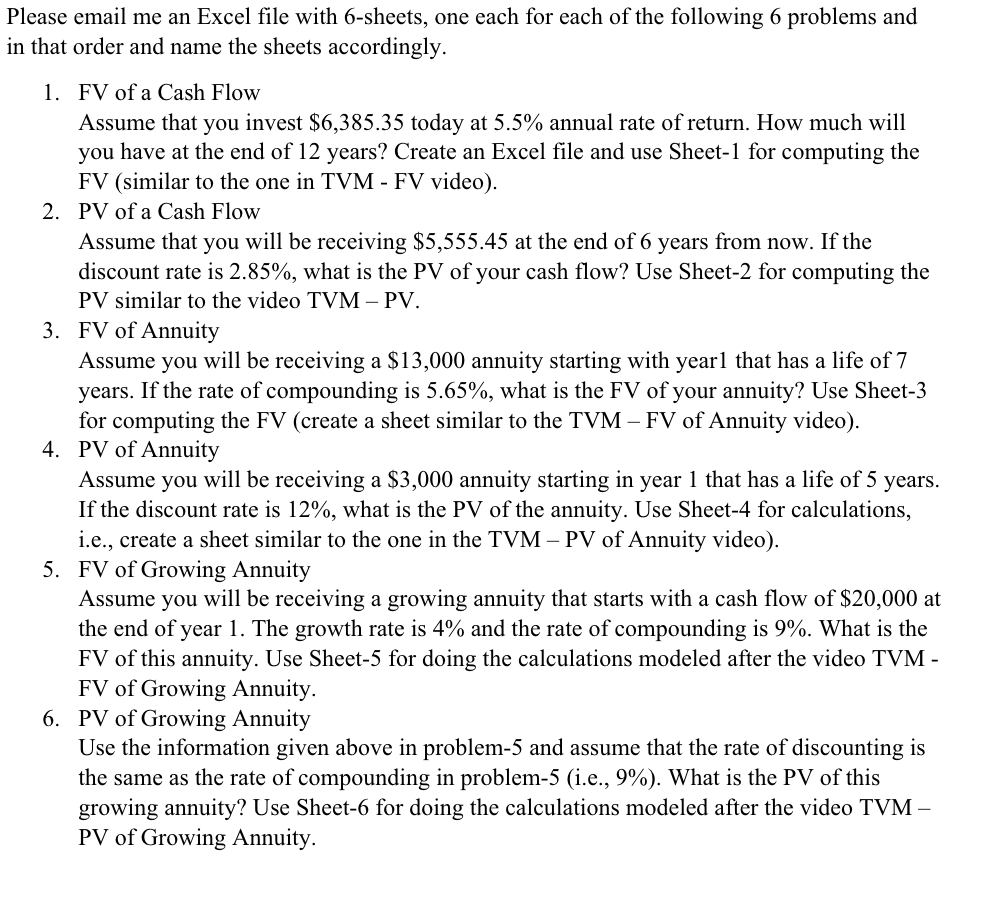

Please email me an Excel file with 6-sheets, one each for each of the following 6 problems and n that order and name the sheets accordingly. 1. FV of a Cash Flow Assume that you invest $6,385.35 today at 5.5% annual rate of return. How much will you have at the end of 12 years? Create an Excel file and use Sheet-1 for computing the FV (similar to the one in TVM - FV video). 2. PV of a Cash Flow Assume that you will be receiving $5,555.45 at the end of 6 years from now. If the discount rate is 2.85%, what is the PV of your cash flow? Use Sheet-2 for computing the PV similar to the video TVM - PV. 3. FV of Annuity Assume you will be receiving a $13,000 annuity starting with year1 that has a life of 7 years. If the rate of compounding is 5.65%, what is the FV of your annuity? Use Sheet-3 for computing the FV (create a sheet similar to the TVM - FV of Annuity video). 4. PV of Annuity Assume you will be receiving a $3,000 annuity starting in year 1 that has a life of 5 years. If the discount rate is 12%, what is the PV of the annuity. Use Sheet-4 for calculations, i.e., create a sheet similar to the one in the TVM - PV of Annuity video). 5. FV of Growing Annuity Assume you will be receiving a growing annuity that starts with a cash flow of $20,000 at the end of year 1 . The growth rate is 4% and the rate of compounding is 9%. What is the FV of this annuity. Use Sheet-5 for doing the calculations modeled after the video TVM FV of Growing Annuity. 6. PV of Growing Annuity Use the information given above in problem-5 and assume that the rate of discounting is the same as the rate of compounding in problem-5 (i.e., 9% ). What is the PV of this growing annuity? Use Sheet-6 for doing the calculations modeled after the video TVM PV of Growing Annuity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts