Question: please enter and use excel formulas to get my solutions posted. Question 1: (18 points) The Old Country Company purchased the following instruments during the

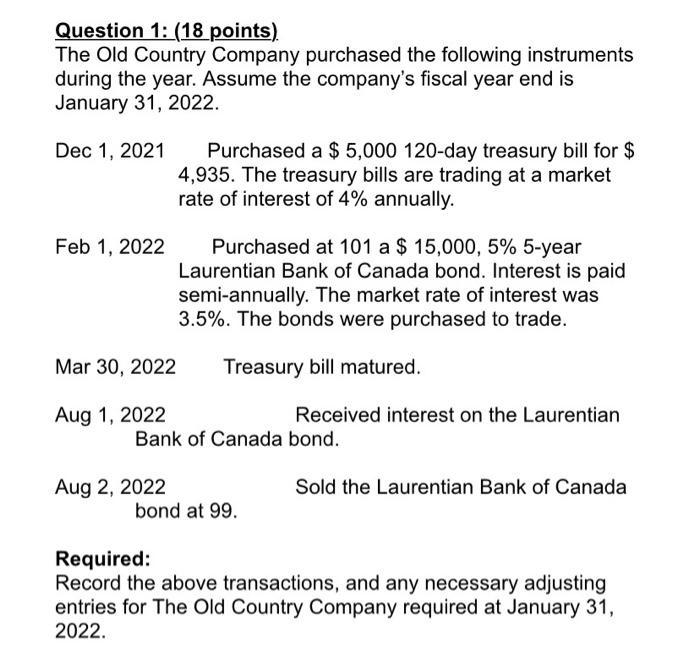

Question 1: (18 points) The Old Country Company purchased the following instruments during the year. Assume the company's fiscal year end is January 31, 2022. Dec 1, 2021 Purchased a $5,000 120-day treasury bill for $ 4,935. The treasury bills are trading at a market rate of interest of 4% annually. Feb 1, 2022 Purchased at 101 a $ 15,000, 5% 5-year Laurentian Bank of Canada bond. Interest is paid semi-annually. The market rate of interest was 3.5%. The bonds were purchased to trade. Mar 30, 2022 Treasury bill matured. Aug 1, 2022 Received interest on the Laurentian Bank of Canada bond. Sold the Laurentian Bank of Canada Aug 2, 2022 bond at 99. Required: Record the above transactions, and any necessary adjusting entries for The Old Country Company required at January 31, 2022. Debit Credit Retuired: The old countrycony Surnal entries Purchase of 120-days treasury bill Date Particulars 1-dec-2021 Investment in Treasure bill Dr. To cash (To record purchase of treasure bill) 4.935 4,935 31-Jan-2022 329 investment in Treasure bill. Dr. To Interest income (To record acquired interest) 329 30-Mar-2022 DE: 33.11 Investment in Treasure bill To Interest income (To record acquired interest) 33.11 Cash 30-Mar-2020 5.001 5.001 To Investment in Treasure ball (To record Treasure bill Matured) Journal entries of 101 Laurentian bank of Canada bond 1-Feb-2022 De 25,000 150 Investment in Bond Premium on bond. Dr. (15,000-5/100*1/5) To Cash (To record purchase of bond 15.150 1-Aug-2022 Dr. 378.75 Cash To interest on Bond. Dr (15,150-5/100*6/12 (To record interest on bond) 378.75 2-Aug-2022 DE Dr. Cash Discount on bond. To Investment in Bond (To record sale of bond) 14,850 150 15.000 Calculation Calculation of interest of Treasure bill Beginning Ending Balance Interest income Balance (Beginning balance interest income) 4.935*4/100*2/12 4,935 4,967.9 = 32.9 4.967.9 4.967.9*4/100*2/12 5.001 -33.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts