Question: PLEASE ENTER INFORMATION AS SHOWN IN THE BLANK TEMPLATE 4. JTM A. JTM pays its C-suite officers with stock options. Treasury asked you to price

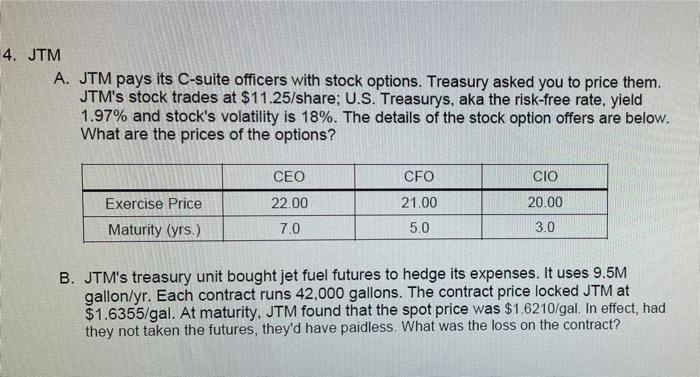

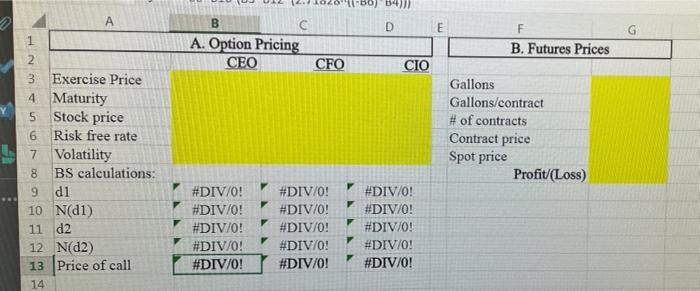

4. JTM A. JTM pays its C-suite officers with stock options. Treasury asked you to price them. JTM's stock trades at $11.25/share: U.S. Treasurys, aka the risk-free rate, yield 1.97% and stock's volatility is 18%. The details of the stock option offers are below. What are the prices of the options? CEO CFO CIO 22.00 21.00 20.00 Exercise Price Maturity (yrs.) 7.0 5.0 3.0 B. JTM's treasury unit bought jet fuel futures to hedge its expenses. It uses 9.5M gallon/yr. Each contract runs 42.000 gallons. The contract price locked JTM at $1.6355/gal. At maturity, JTM found that the spot price was $1.6210/gal . In effect, had they not taken the futures, they'd have paidless. What was the loss on the contract? BO) 640 D E G B A. Option Pricing CEO CFO F B. Futures Prices wN CIO 2 3 Exercise Price 4 Maturity 5 Stock price 6 Risk free rate 7 Volatility 8 BS calculations: 9 di 10 N(1) 11 d2 12 N(2) 13 Price of call 14 Gallons Gallons/contract # of contracts Contract price Spot price Profit/(Loss) #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts