Question: PLEASE ENTER INFORMATION AS SHOWN ON BLANK THE TEMPLATE 3. JTM's treasury office is looking at buying a bond to earn some money on its

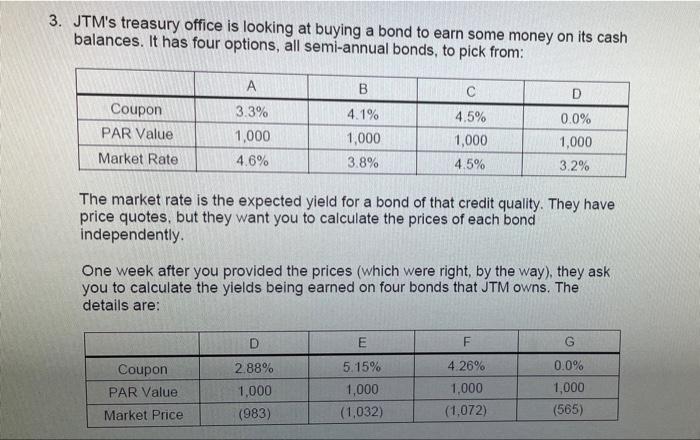

3. JTM's treasury office is looking at buying a bond to earn some money on its cash balances. It has four options, all semi-annual bonds, to pick from: B Coupon PAR Value 3.3% 1,000 4.6% 4.1% 1,000 3.8% 4.5% 1,000 4.5% D 0.0% 1,000 3.2% Market Rate The market rate is the expected yield for a bond of that credit quality. They have price quotes, but they want you to calculate the prices of each bond independently. One week after you provided the prices (which were right, by the way), they ask you to calculate the yields being earned on four bonds that JTM owns. The details are: D F G Coupon PAR Value Market Price 2.88% 1,000 (983) 5.15% 1,000 (1,032) 4.26% 1,000 (1,072) 0.0% 1,000 (565) A1 A B C D 1 F A G H B 1 D D E F CA One 4.3 2 Coupon 3 Par Value 4 Market Rate 5 Cash Flows: 6 0.5 7 1.0 8 1:5 9 2.0 10 2.5 11 3.0 12 3.5 13 4.0 14 15 5.0 16 17 6.0 18 6.5 19 7.0 20 7.5 21 8.0 22 8.5 23 9.0 24 95 25 10.0 105 27 11.0 28 11.5 20 12.0 30 31 Price Coupon Par Value Cash flows: Market Price 0.5 1.0 1.5 2.0 2.5 3.0 3,5 4.0 4.5 5.0 5.5 6,0 6.5 7.0 7.5 80 8.5 9.0 95 100 10.5 11.0 11.5 12.0 5.5 DOO Yield Prob. 1 Prob. 2 Prob. 3 Prob. 4 V. NOV 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts