Question: Please enter the correct formula in the colored excel space to complete the answer, thanksss! begin{tabular}{|c|c|c|c|c|c|} hline multicolumn{6}{|l|}{ Multinational Financial Management } hline &

Please enter the correct formula in the colored excel space to complete the answer, thanksss!

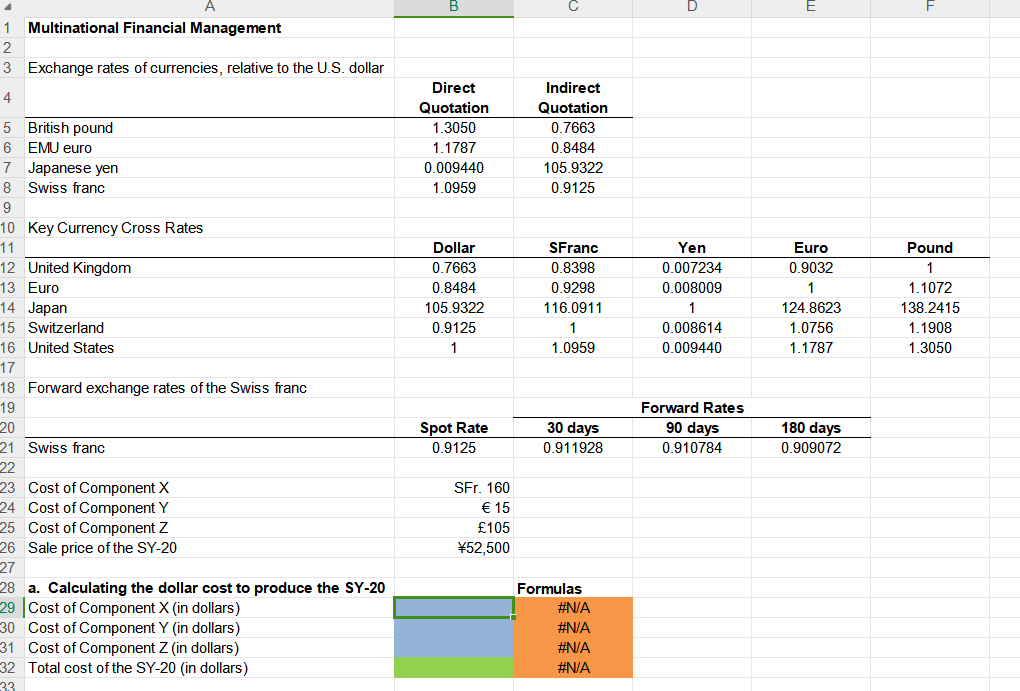

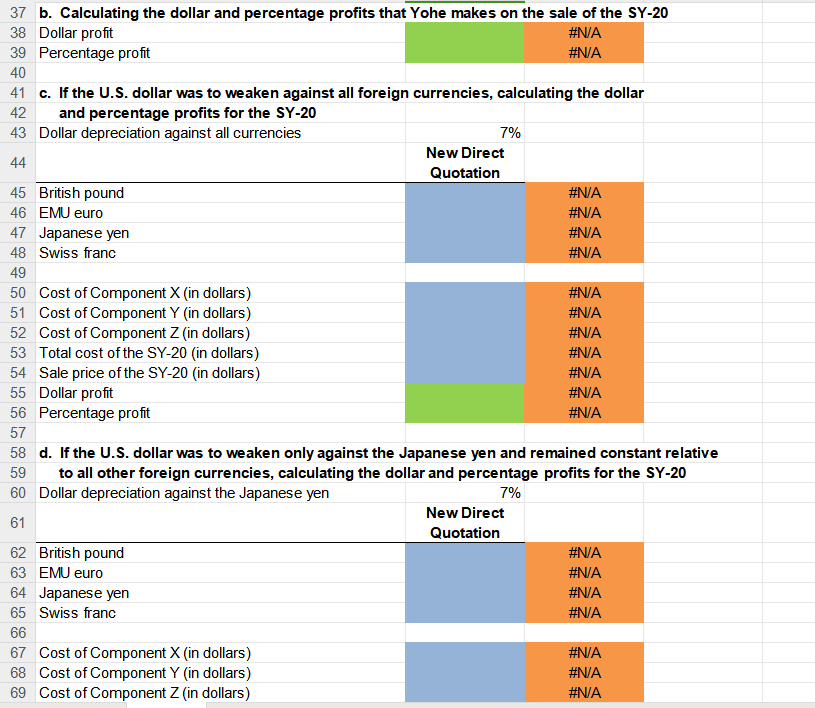

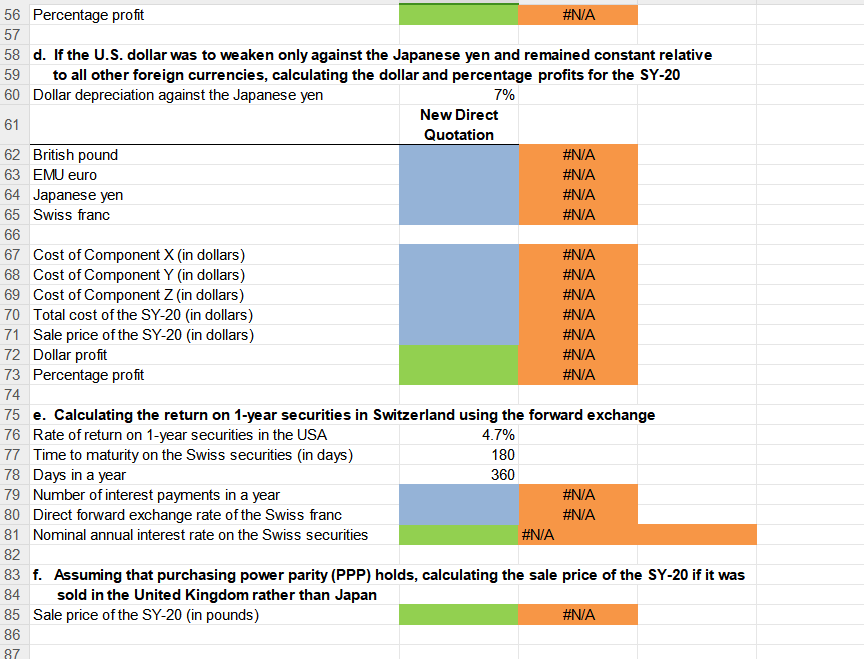

\begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|l|}{ Multinational Financial Management } \\ \hline & & & & & \\ \hline \multicolumn{6}{|l|}{ Exchange rates of currencies, relative to the U.S. dollar } \\ \hline & DirectQuotation & IndirectQuotation & & & \\ \hline British pound & 1.3050 & 0.7663 & & & \\ \hline EMU euro & 1.1787 & 0.8484 & & & \\ \hline Japanese yen & 0.009440 & 105.9322 & & & \\ \hline Swiss franc & 1.0959 & 0.9125 & & & \\ \hline & & & & & \\ \hline \multicolumn{6}{|l|}{ Key Currency Cross Rates } \\ \hline & Dollar & SFranc & Yen & Euro & Pound \\ \hline United Kingdom & 0.7663 & 0.8398 & 0.007234 & 0.9032 & 1 \\ \hline Euro & 0.8484 & 0.9298 & 0.008009 & 1 & 1.1072 \\ \hline Japan & 105.9322 & 116.0911 & 1 & 124.8623 & 138.2415 \\ \hline Switzerland & 0.9125 & 1 & 0.008614 & 1.0756 & 1.1908 \\ \hline United States & 1 & 1.0959 & 0.009440 & 1.1787 & 1.3050 \\ \hline & & & & & \\ \hline \multicolumn{6}{|l|}{ Forward exchange rates of the Swiss franc } \\ \hline & & \multicolumn{3}{|c|}{ Forward Rates } & \\ \hline & Spot Rate & 30 days & 90 days & 180 days & \\ \hline Swiss franc & 0.9125 & 0.911928 & 0.910784 & 0.909072 & \\ \hline Cost of Component X & SFr. 160 & & & & \\ \hline Cost of Component Y & 15 & & & & \\ \hline Cost of Component Z & 105 & & & & \\ \hline Sale price of the SY-20 & 52,500 & & & & \\ \hline a. Calculating the dollar cost to produce the SY-20 & & Formulas & & & \\ \hline Cost of Component X (in dollars) & & \#N/A & & & \\ \hline Cost of Component Y (in dollars) & & \#N/A & & & \\ \hline Cost of Component Z (in dollars) & & \#N/A & & & \\ \hline Total cost of the SY-20 (in dollars) & & \#N/A & & & \\ \hline \end{tabular} 37 b. Calculating the dollar and percentage profits that Yohe makes on the sale of the SY-20 38 Dollar profit \#N/A Percentage profit \#N/A c. If the U.S. dollar was to weaken against all foreign currencies, calculating the dollar and percentage profits for the SY-20 Dollar depreciation against all currencies 7% New Direct Quotation 44 \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A 45 British pound 46 EMU euro 47 Japanese yen 48 Swiss franc 49 50 Cost of Component X (in dollars) 51 Cost of Component Y (in dollars) 52 Cost of Component Z (in dollars) 53 Total cost of the SY-20 (in dollars) 54 Sale price of the SY-20 (in dollars) 55 Dollar profit 56 Percentage profit 58 d. If the U.S. dollar was to weaken only against the Japanese yen and remained constant relative 59 60 Dollar depreciation against the Japanese yen 61 62 British pound 63 EMU euro 64 Japanese yen 65 Swiss franc 66 67 Cost of Component X (in dollars) 68 Cost of Component Y (in dollars) 69 Cost of Component Z (in dollars) 69 Cost of Component Z (in dollars) 7% New Direct Quotation 56 Percentage profit \#N/A d. If the U.S. dollar was to weaken only against the Japanese yen and remained constant relative to all other foreign currencies, calculating the dollar and percentage profits for the SY-20 Dollar depreciation against the Japanese yen 7% New Direct Quotation British pound EMU euro Japanese yen Swiss franc Cost of Component X (in dollars) Cost of Component Y (in dollars) Cost of Component Z (in dollars) Total cost of the SY-20 (in dollars) Sale price of the SY-20 (in dollars) Dollar profit Percentage profit e. Calculating the return on 1-year securities in Switzerland using the forward exchange Rate of return on 1-year securities in the USA Time to maturity on the Swiss securities (in days) Days in a year Number of interest payments in a year Direct forward exchange rate of the Swiss franc Nominal annual interest rate on the Swiss securities 4.7% 180 360 \#N/A f. Assuming that purchasing power parity (PPP) holds, calculating the sale price of the SY-20 if it was sold in the United Kingdom rather than Japan Sale price of the SY-20 (in pounds) \#N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts