Question: Please expert solve all problems.thank you. Question 2 a) Consider two stocks, A and B. Stock A has an expected return of 10% and standard

Please expert solve all problems.thank you.

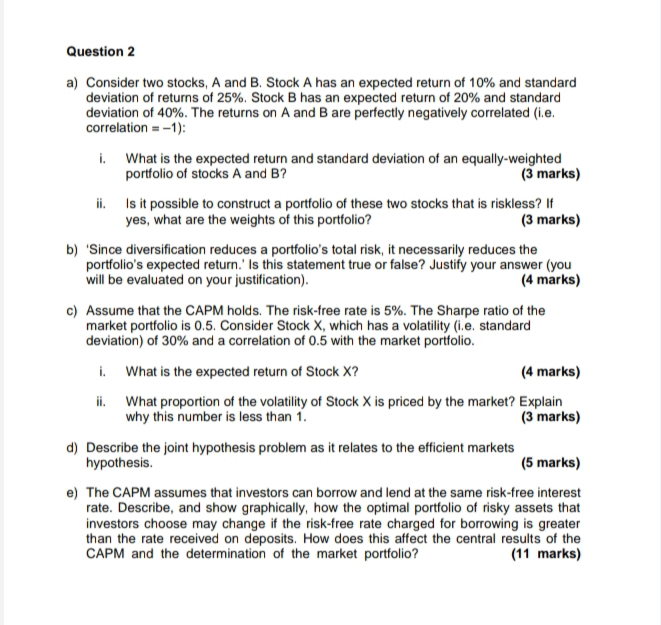

Question 2 a) Consider two stocks, A and B. Stock A has an expected return of 10% and standard deviation of returns of 25% Stock B has an expected return of 20% and standard deviation of 40%. The returns on A and B are perfectly negatively correlated (ie. correlation = -1): i. What is the expected return and standard deviation of an equally-weighted portfolio of stocks A and B? (3 marks) ii. Is it possible to construct a portfolio of these two stocks that is riskless? If yes, what are the weights of this portfolio? (3 marks) b) 'Since diversification reduces a portfolio's total risk, it necessarily reduces the portfolio's expected return.' Is this statement true or false? Justify your answer (you will be evaluated on your justification). (4 marks) c) Assume that the CAPM holds. The risk-free rate is 5%. The Sharpe ratio of the market portfolio is 0.5. Consider Stock X, which has a volatility (i.e. standard deviation) of 30% and a correlation of 0.5 with the market portfolio. i. What is the expected return of Stock X? (4 marks) ii. What proportion of the volatility of Stock X is priced by the market? Explain why this number is less than 1. (3 marks) d) Describe the joint hypothesis problem as it relates to the efficient markets hypothesis. (5 marks) e) The CAPM assumes that investors can borrow and lend at the same risk-free interest rate. Describe, and show graphically, how the optimal portfolio of risky assets that investors choose may change if the risk-free rate charged for borrowing is greater than the rate received on deposits. How does this affect the central results of the CAPM and the determination of the market portfolio? (11 marks) Question 2 a) Consider two stocks, A and B. Stock A has an expected return of 10% and standard deviation of returns of 25% Stock B has an expected return of 20% and standard deviation of 40%. The returns on A and B are perfectly negatively correlated (ie. correlation = -1): i. What is the expected return and standard deviation of an equally-weighted portfolio of stocks A and B? (3 marks) ii. Is it possible to construct a portfolio of these two stocks that is riskless? If yes, what are the weights of this portfolio? (3 marks) b) 'Since diversification reduces a portfolio's total risk, it necessarily reduces the portfolio's expected return.' Is this statement true or false? Justify your answer (you will be evaluated on your justification). (4 marks) c) Assume that the CAPM holds. The risk-free rate is 5%. The Sharpe ratio of the market portfolio is 0.5. Consider Stock X, which has a volatility (i.e. standard deviation) of 30% and a correlation of 0.5 with the market portfolio. i. What is the expected return of Stock X? (4 marks) ii. What proportion of the volatility of Stock X is priced by the market? Explain why this number is less than 1. (3 marks) d) Describe the joint hypothesis problem as it relates to the efficient markets hypothesis. (5 marks) e) The CAPM assumes that investors can borrow and lend at the same risk-free interest rate. Describe, and show graphically, how the optimal portfolio of risky assets that investors choose may change if the risk-free rate charged for borrowing is greater than the rate received on deposits. How does this affect the central results of the CAPM and the determination of the market portfolio? (11 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts