Question: Please explain 1 and 2. I don't understand where the (1/2) is coming from. When I enter the formula in the green box I'm not

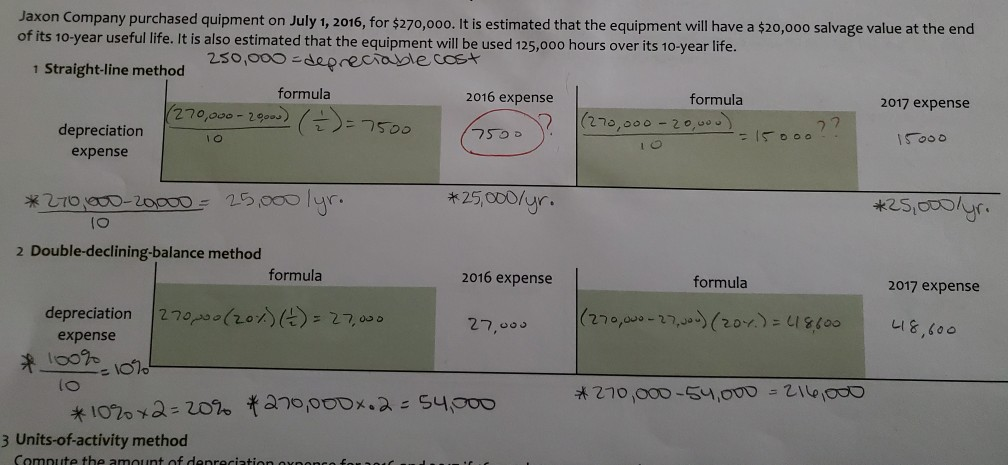

Please explain 1 and 2. I don't understand where the (1/2) is coming from. When I enter the formula in the green box I'm not getting 7500 on my calculator. I'm very confused as to why my answers with the * are wrong.

Jaxon Company purchased quipment on July 1, 2016, for $270,000. It is estimated that the equipment will have a $20,00o salvage value at the end of its 10-year useful life. It is also estimated that the equipment will be used 125,000 hours over its 10-year life. 250,000 -depreciable cost 1 Straight-line method formula 2016 expense formula 2017 expense (270,000-2900) ()=7500 (270,000-20,00) 15000 7500 depreciation expense ( *25,000/yr. 25,000lyr. *270 000-20000. 2 Double-declining-balance method 2016 expense formula formula 2017 expense (270,000-27,00)(20r.)= 18600 L18,600 depreciation 270p00(207)()= 27,000 27,000 expense 100% *270,000 -54,000=216,0 10 * 10%0 x2= 20% ta70,00Ox.2=54,00o 3 Units-of-activity method Compute the amount of denreciation oxponce

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts