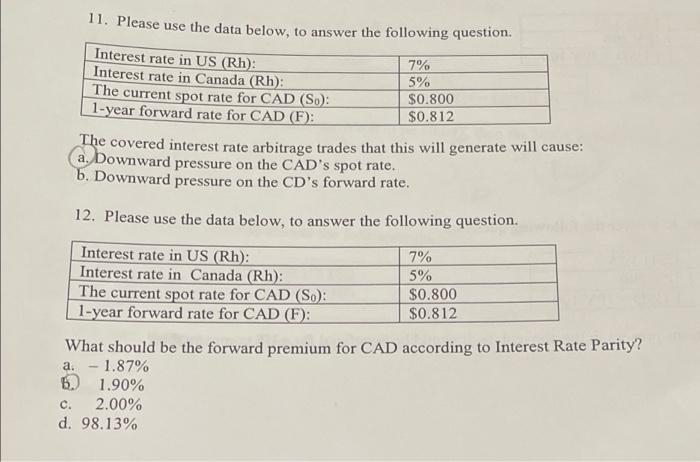

Question: please explain 11. Please use the data below, to answer the following question. Interest rate in US (Rh): 7% Interest rate in Canada (Rh): 5%

11. Please use the data below, to answer the following question. Interest rate in US (Rh): 7% Interest rate in Canada (Rh): 5% The current spot rate for CAD (So): 1-year forward rate for CAD (F): $0.812 The covered interest rate arbitrage trades that this will generate will cause: a. bownward pressure on the CAD's spot rate. b. Downward pressure on the CD's forward rate. $0.800 12. Please use the data below, to answer the following question. Interest rate in US (Rh): 7% Interest rate in Canada (Rh): 5% The current spot rate for CAD (SO): $0.800 1-year forward rate for CAD (F): $0.812 What should be the forward premium for CAD according to Interest Rate Parity? a.- 1.87% 61.90% 2.00% d. 98.13% C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts