Question: please explain 6.25 poi QUESTION 1 Q1-Q7 are based on the following information Acquiring Company is considering the acquisition of Target Company in a stock

please explain

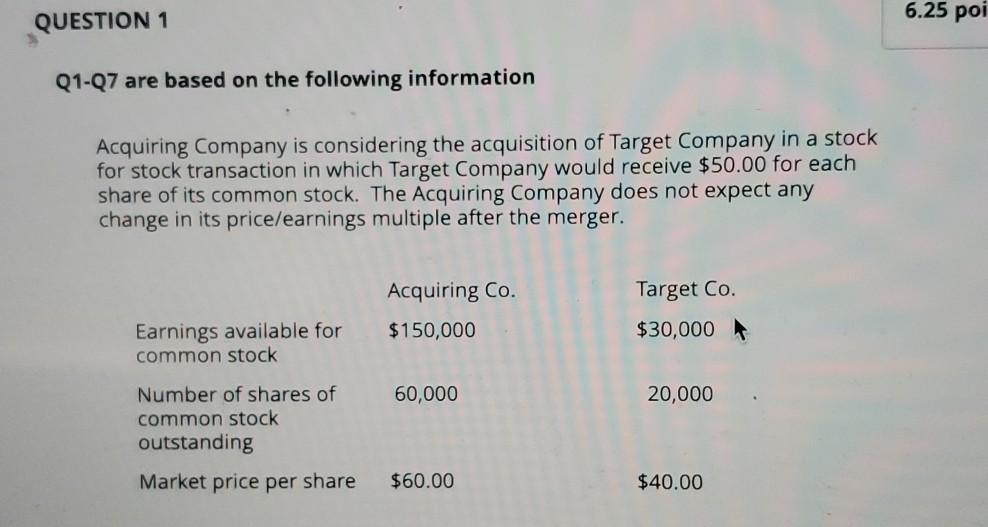

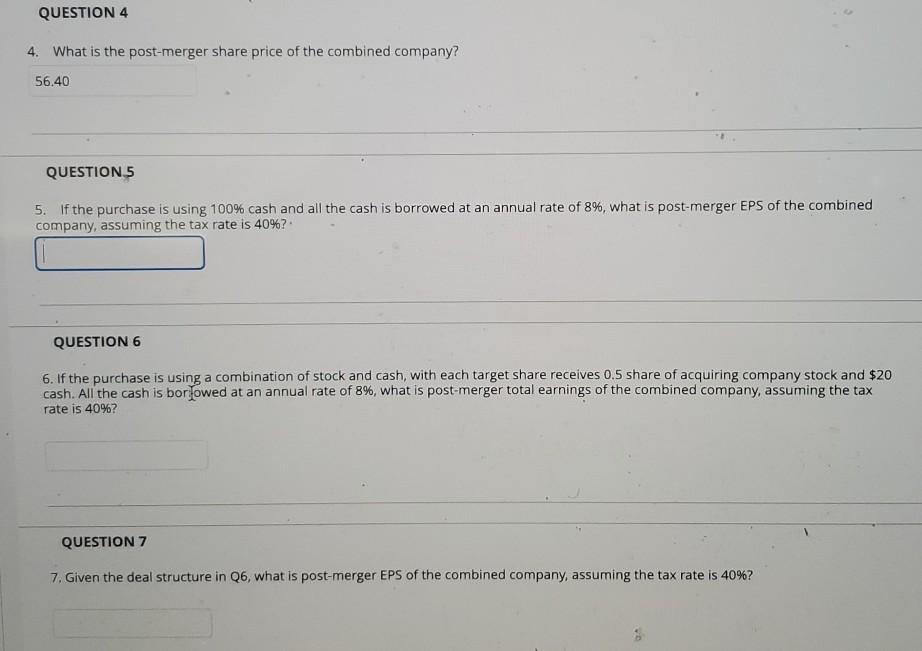

6.25 poi QUESTION 1 Q1-Q7 are based on the following information Acquiring Company is considering the acquisition of Target Company in a stock for stock transaction in which Target Company would receive $50.00 for each share of its common stock. The Acquiring Company does not expect any change in its price/earnings multiple after the merger. Acquiring Co. $150,000 Target Co. $30,000 Earnings available for common stock 60,000 20,000 Number of shares of common stock outstanding Market price per share $60.00 $40.00 QUESTION 4 4. What is the post-merger share price of the combined company? 56.40 QUESTIONS 5. If the purchase is using 100% cash and all the cash is borrowed at an annual rate of 8%, what is post-merger EPS of the combined company, assuming the tax rate is 40%? QUESTION 6 6. If the purchase is using a combination of stock and cash, with each target share receives 0.5 share of acquiring company stock and $20 cash. All the cash is bor lowed at an annual rate of 8%, what is post-merger total earnings of the combined company, assuming the tax rate is 40%? QUESTION 7 7. Given the deal structure in Q6, what is post-merger EPS of the combined company, assuming the tax rate is 40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts