Question: Please explain 6,7 and 8 better/ if they are correct answers circle. Thanks! nat is Bank B standard w 's deviation of its asset allocation

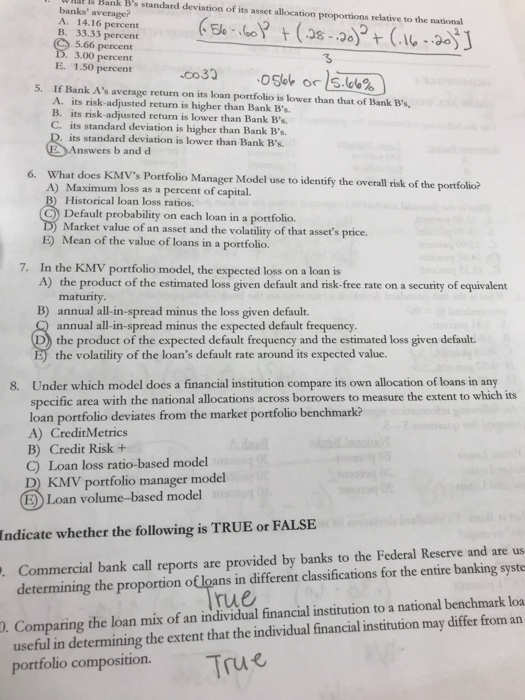

nat is Bank B standard w 's deviation of its asset allocation proportions relative to the national banks' average? A. 14.16 percent B. 33.33 percent 5.66 percent E. 1.50 percent 5. If Bank A's average return on its loan portfolio is lower than that of Bank B's, A. its risk-adjusted return is higher than Bank B's. B. its risk-adjusted return is lower than Bank B's. C. its standard deviation is higher than Bank B's. its standard deviation is lower than Bank B's. nswers b and d What does KMV's Portfolio Manager Model use to identify the overall risk of the portfolio? A) Maximum loss as a percent of capital. 6. Historical loan loss ratios. Default probability on each loan in a portfolio. Market value of an asset and the volatility of that asset's price. E) Mean of the value of loans in a portfolio. 7. In the KMV portfolio model, the expected loss on a loan is A) the product of the estimated loss given default and risk-free rate on a security of equivalent maturity B) annual all-in-spread minus the loss given default. annual all-in-spread minus the expected default frequency. D the product of the expected default frequency and the estimated loss given defaulr the volatility of the loan's default rate around its expected value. 8. Under which model does a financial institution compare its own allocation of loans in any area with the national allocations across borrowers to measure the extent to which its loan portfolio deviates from the market portfolio benchmark? A) CreditMetrics B) Credit Risk+ C) Loan loss ratio-based model D) KMV portfolio manager model E)) Loan volume-based model Indicate whether the following is TRUE or FALSE Commercial bank call reports are provided by banks to the Federal Reserve and are us determining the proportion of loans in different classifications for the entire banking syste . rue useful in determining the extent that the individual financial institution may differ from an portfolio composition . Comparing the loan mix of an individual financial institution to a national benchmark loa rue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts