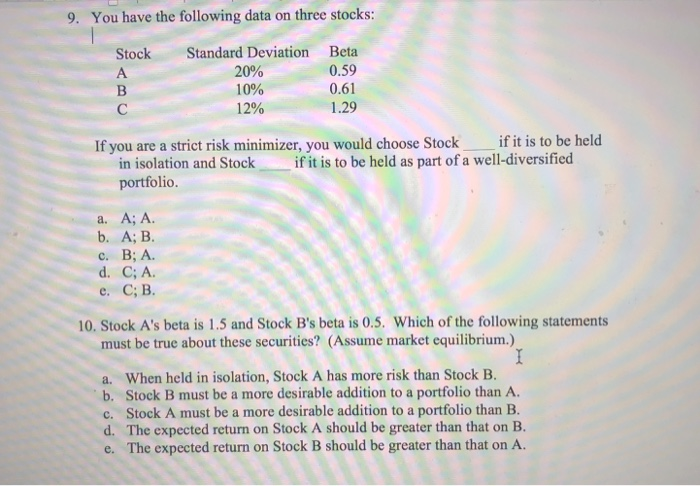

Question: please explain 9. You have the following data on three stocks: StockStandard Deviation Beta 20% 10% 12% 0.59 0.61 1.29 If you are a strict

9. You have the following data on three stocks: StockStandard Deviation Beta 20% 10% 12% 0.59 0.61 1.29 If you are a strict risk minimizer, you would choose Stockf it is to be held in isolation and Stockif it is to be held as part of a well-diversified portfolio. a. A; A b. A; B c. B; A. d. C; A. e. C; B. 10. Stock A's beta is 1.5 and Stock B's beta is 0.5. Which of the following statements must be true about these securities? (Assume market equilibrium.) a. When held in isolation, Stock A has more risk than Stock B. b. Stock B must be a more desirable addition to a portfolio than A. c. Stock A must be a more desirable addition to a portfolio than B. d. The expected return on Stock A should be greater than that on B. e. The expected return on Stock B should be greater than that on A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts