Question: Please explain all answers and calculations as much as possible afeter completing the answer. QUESTION TWO DISPOSAL OF PROPERTY, PLANT AND EQUIPMENT 15 MARKS) The

Please explain all answers and calculations as much as possible afeter completing the answer.

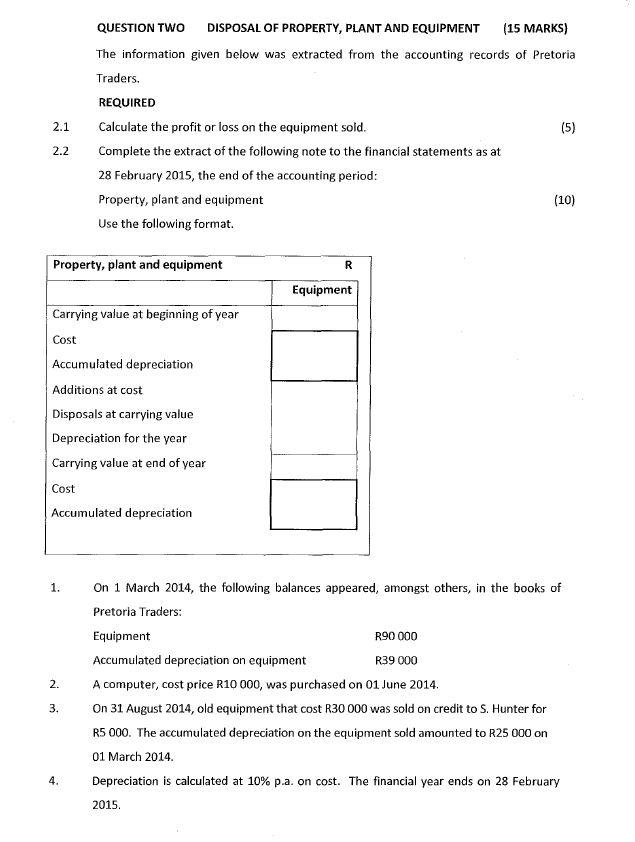

QUESTION TWO DISPOSAL OF PROPERTY, PLANT AND EQUIPMENT 15 MARKS) The information given below was extracted from the accounting records of Pretoria Traders. REQUIRED Calculate the profit or loss on the equipment sold Complete the extract of the following note to the financial statements as at 28 February 2015, the end of the accounting period Property, plant and equipment Use the following format 2.1 2.2 (10) Property, plant and equipment Equipment Carrying value at beginning of year Cost Accumulated depreciation Additions at cost Disposals at carrying value Depreciation for the year Carrying value at end of year Cost Accumulated depreciation On 1 March 2014, the following balances appeared, amongst others, in the books of Pretoria Traders: Equipment Accumulated depreciation on equipment R90 000 R39 000 2 Acomputer, cost price R10 000, was purchased on 01 June 2014 3. On 31 August 2014, old equipment that cost R30 000 was sold on credit to S. Hunter for R5 000. The accumulated depreciation on the equipment sold amounted to R25 000 on 01 March 2014. Depreciation is calculated at 10% pa. on cost. The financial year ends on 28 February 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts