Question: Please explain all calculations. Thank you! value 2.00 points Esquire Inc. uses the LIFO method to value its inventory. Inventory at January 1, 2016, was

Please explain all calculations. Thank you!

Please explain all calculations. Thank you!

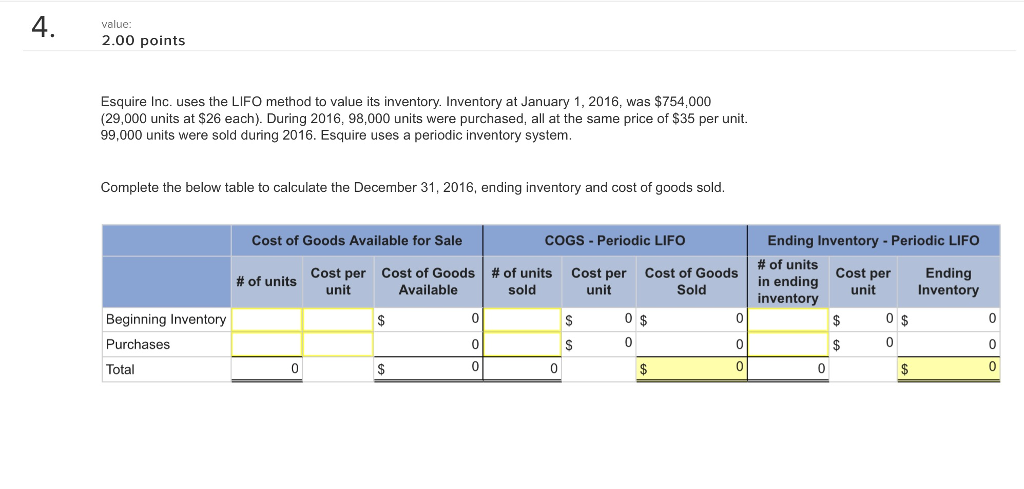

value 2.00 points Esquire Inc. uses the LIFO method to value its inventory. Inventory at January 1, 2016, was $754,000 (29,000 units at $26 each). During 2016, 98,000 units were purchased, all at the same price of $35 per unit. 99,000 units were sold during 2016. Esquire uses a periodic inventory system. Complete the below table to calculate the December 31, 2016, ending inventory and cost of goods sold. Cost of Goods Available for Sale COGS Periodic LIFO Ending Inventory Periodic LIFO of units cost per of units Cost per Cost of Goods of units Cost per Cost of Goods unit Available sold unit Sold Ending in ending unit inventory Inventory S 0 0 0 0 s 0 Beginning Inventory 0 0 0 Purchases 0 s 0 s 0 Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts