Question: Please explain all steps and formulas 6. (8 pts) Consider the following two mutually exclusive investment projects for which MARR = 15%: Net Cash Flow

Please explain all steps and formulas

Please explain all steps and formulas

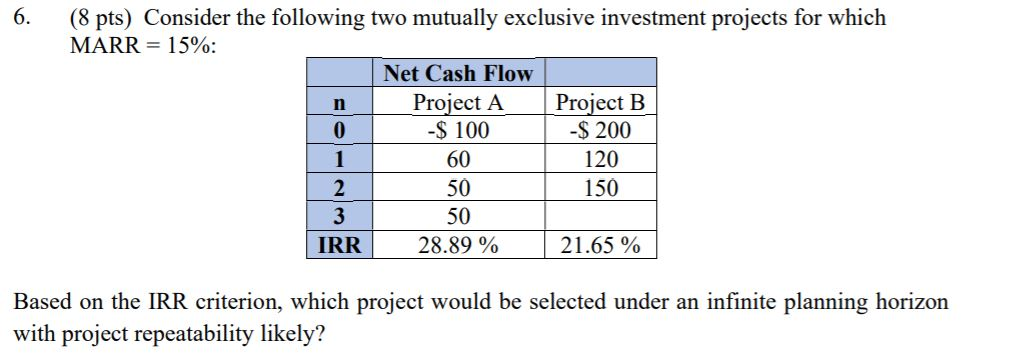

6. (8 pts) Consider the following two mutually exclusive investment projects for which MARR = 15%: Net Cash Flow Project A Project B 0 -$ 100 -$ 200 1 60 120 2 50 150 3 IRR 28.89 % 21.65 % 50 Based on the IRR criterion, which project would be selected under an infinite planning horizon with project repeatability likely? 6. (8 pts) Consider the following two mutually exclusive investment projects for which MARR = 15%: Net Cash Flow Project A Project B 0 -$ 100 -$ 200 1 60 120 2 50 150 3 IRR 28.89 % 21.65 % 50 Based on the IRR criterion, which project would be selected under an infinite planning horizon with project repeatability likely

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts