Question: Please explain all steps and why this entry is useful. Recording a Deferred Tax Allowance Allied Corp. has a deferred tax asset balance of $70,000

Please explain all steps and why this entry is useful.

Please explain all steps and why this entry is useful.

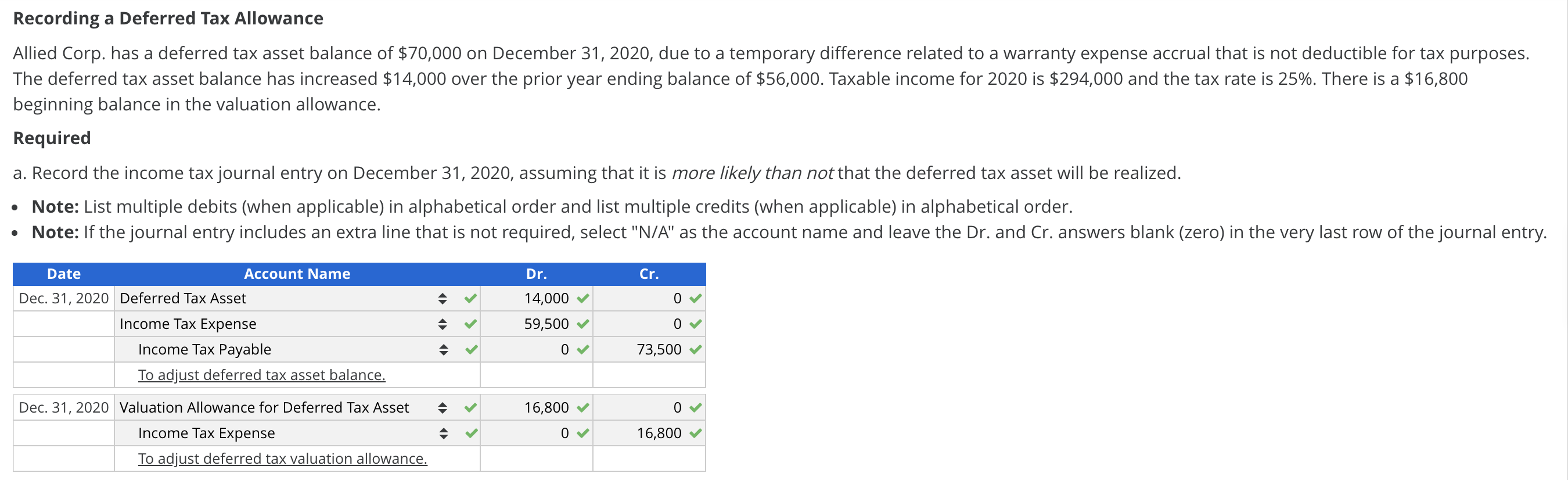

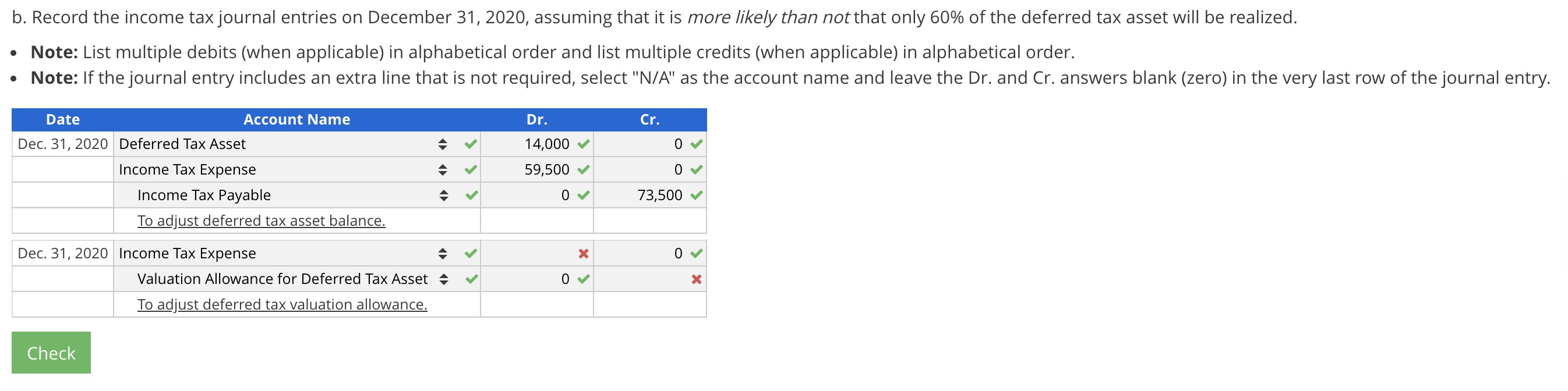

Recording a Deferred Tax Allowance Allied Corp. has a deferred tax asset balance of $70,000 on December 31, 2020, due to a temporary difference related to a warranty expense accrual that is not deductible for tax purposes. The deferred tax asset balance has increased $14,000 over the prior year ending balance of $56,000. Taxable income for 2020 is $294,000 and the tax rate is 25%. There is a $16,800 beginning balance in the valuation allowance. Required a. Record the income tax journal entry on December 31, 2020, assuming that it is more likely than not that the deferred tax asset will be realized. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Note: If the journal entry includes an extra line that is not required, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero) in the very last row of the journal entry. Date Account Name Dr. Cr. 0 14,000 59,500 0 Dec. 31, 2020 Deferred Tax Asset Income Tax Expense Income Tax Payable To adjust deferred tax asset balance. . 0 73,500 16,800 0 Dec. 31, 2020 Valuation Allowance for Deferred Tax Asset Income Tax Expense To adjust deferred tax valuation allowance. 0 16,800 b. Record the income tax journal entries on December 31, 2020, assuming that it is more likely than not that only 60% of the deferred tax asset will be realized. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Note: If the journal entry includes an extra line that is not required, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero) in the very last row of the journal entry. Dr. Cr. 0 Date Account Name Dec. 31, 2020 Deferred Tax Asset Income Tax Expense Income Tax Payable To adjust deferred tax asset balance. 14,000 59,500 A 0 . 0 73,500 x 0 Dec. 31, 2020 Income Tax Expense Valuation Allowance for Deferred Tax Asset A 0 x To adjust deferred tax valuation allowance. Check Recording a Deferred Tax Allowance Allied Corp. has a deferred tax asset balance of $70,000 on December 31, 2020, due to a temporary difference related to a warranty expense accrual that is not deductible for tax purposes. The deferred tax asset balance has increased $14,000 over the prior year ending balance of $56,000. Taxable income for 2020 is $294,000 and the tax rate is 25%. There is a $16,800 beginning balance in the valuation allowance. Required a. Record the income tax journal entry on December 31, 2020, assuming that it is more likely than not that the deferred tax asset will be realized. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Note: If the journal entry includes an extra line that is not required, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero) in the very last row of the journal entry. Date Account Name Dr. Cr. 0 14,000 59,500 0 Dec. 31, 2020 Deferred Tax Asset Income Tax Expense Income Tax Payable To adjust deferred tax asset balance. . 0 73,500 16,800 0 Dec. 31, 2020 Valuation Allowance for Deferred Tax Asset Income Tax Expense To adjust deferred tax valuation allowance. 0 16,800 b. Record the income tax journal entries on December 31, 2020, assuming that it is more likely than not that only 60% of the deferred tax asset will be realized. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Note: If the journal entry includes an extra line that is not required, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero) in the very last row of the journal entry. Dr. Cr. 0 Date Account Name Dec. 31, 2020 Deferred Tax Asset Income Tax Expense Income Tax Payable To adjust deferred tax asset balance. 14,000 59,500 A 0 . 0 73,500 x 0 Dec. 31, 2020 Income Tax Expense Valuation Allowance for Deferred Tax Asset A 0 x To adjust deferred tax valuation allowance. Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts