Question: please explain all steps, Im trying to learn, thank you. Required information State-of-the-art digital imaging equipment purchased 2 years ago for $50,000 had an expected

please explain all steps, Im trying to learn, thank you.

please explain all steps, Im trying to learn, thank you.

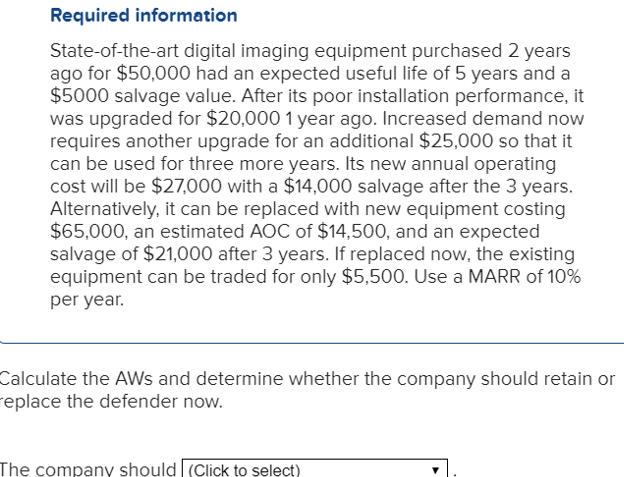

Required information State-of-the-art digital imaging equipment purchased 2 years ago for $50,000 had an expected useful life of 5 years and a $5000 salvage value. After its poor installation performance, it was upgraded for $20,000 1 year ago. Increased demand now requires another upgrade for an additional $25,000 so that it can be used for three more years. Its new annual operating cost will be $27,000 with a $14,000 salvage after the 3 years. Alternatively, it can be replaced with new equipment costing $65,000, an estimated AOC of $14,500, and an expected salvage of $21,000 after 3 years. If replaced now, the existing equipment can be traded for only $5,500. Use a MARR of 10% per year Calculate the AWs and determine whether the company should retain or eplace the defender now. The company should (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts