Question: please explain all steps, Im trying to learn, thank you. A presently owned machine has the projected market value and M&O costs shown below. An

please explain all steps, Im trying to learn, thank you.

please explain all steps, Im trying to learn, thank you.

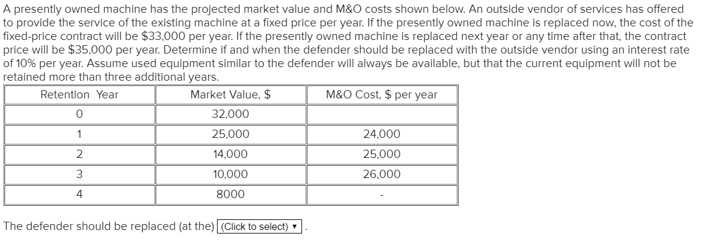

A presently owned machine has the projected market value and M&O costs shown below. An outside vendor of services has offered to provide the service of the existing machine at a fixed price per year. If the presently owned machine is replaced now, the cost of the fixed-price contract will be $33,000 per year. If the presently owned machine is replaced next year or any time after that, the contract price will be $35,000 per year. Determine if and when the defender should be replaced with the outside vendor using an interest rate of 10% per year. Assume used equipment similar to the defender will always be available, but that the current equipment will not be retained more than three additional years Market Value, $ 32,000 25,000 14,000 10,000 8000 Retention Year M&O Cost, $ per year 0 24,000 25,000 26,000 2 4 The defender should be replaced (at the) (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts