Question: Please explain all steps Jerry, a partner in the JSK partnership, begins the year on January 1, 2021 with a capital balance of $20,000. The

Please explain all steps

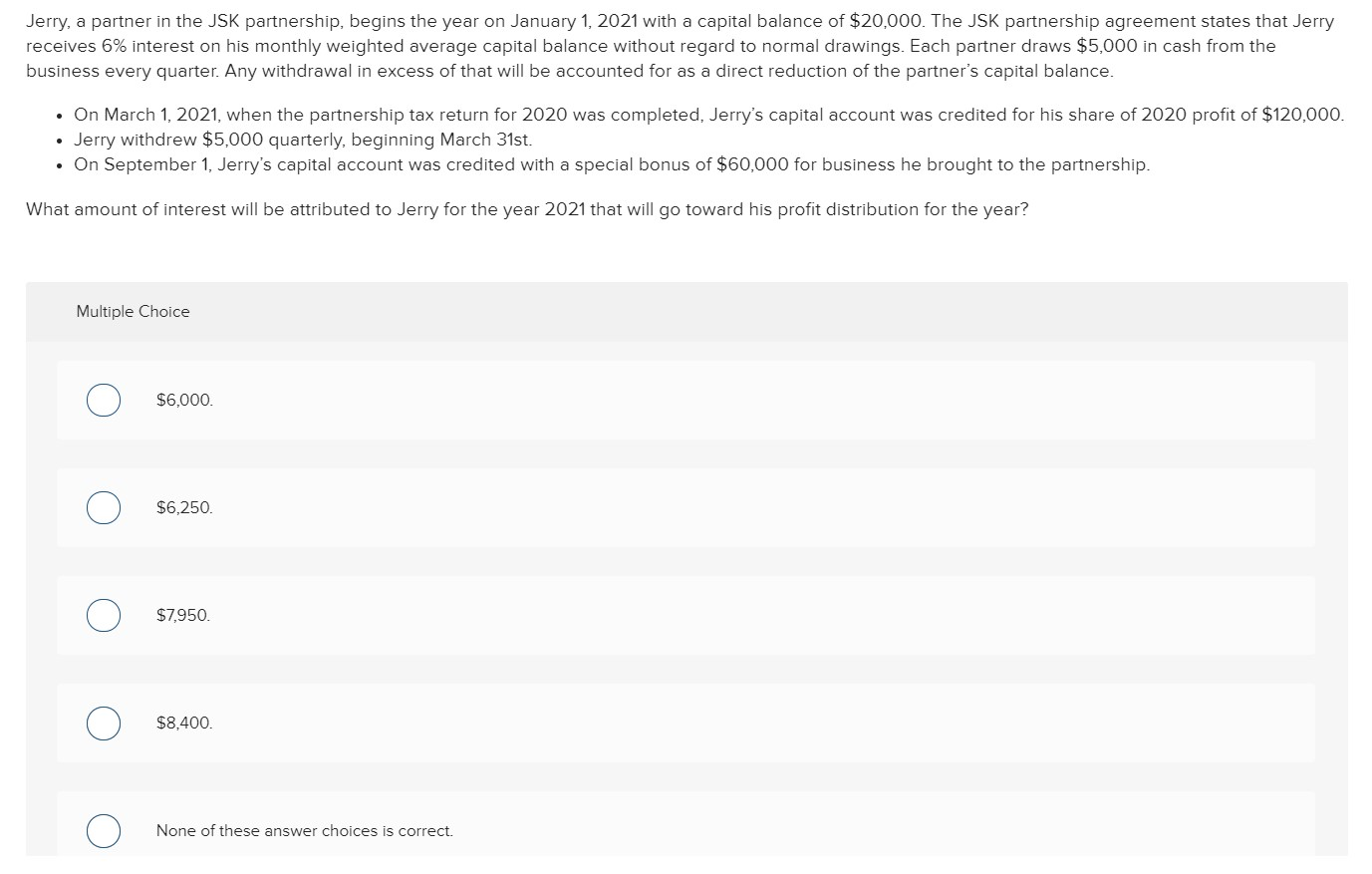

Jerry, a partner in the JSK partnership, begins the year on January 1, 2021 with a capital balance of $20,000. The JSK partnership agreement states that Jerry receives 6% interest on his monthly weighted average capital balance without regard to normal drawings. Each partner draws $5,000 in cash from the business every quarter. Any withdrawal in excess of that will be accounted for as a direct reduction of the partner's capital balance. . . On March 1, 2021, when the partnership tax return for 2020 was completed, Jerry's capital account was credited for his share of 2020 profit of $120,000. Jerry withdrew $5,000 quarterly, beginning March 31st. . On September 1, Jerry's capital account was credited with a special bonus of $60,000 for business he brought to the partnership. What amount of interest will be attributed to Jerry for the year 2021 that will go toward his profit distribution for the year? Multiple Choice $6,000. $6,250. U O $7.950. $8,400. None of these answer choices is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts