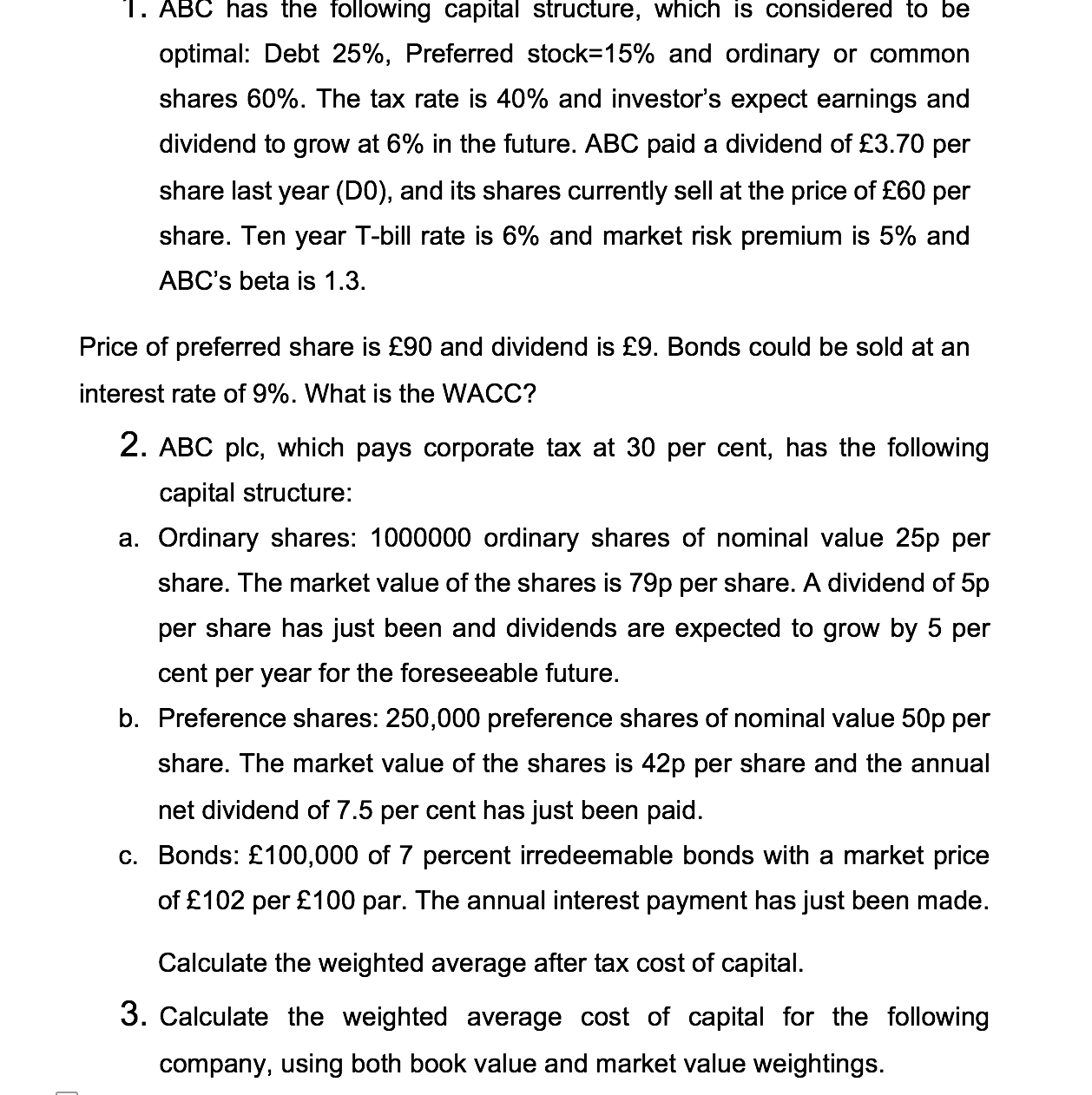

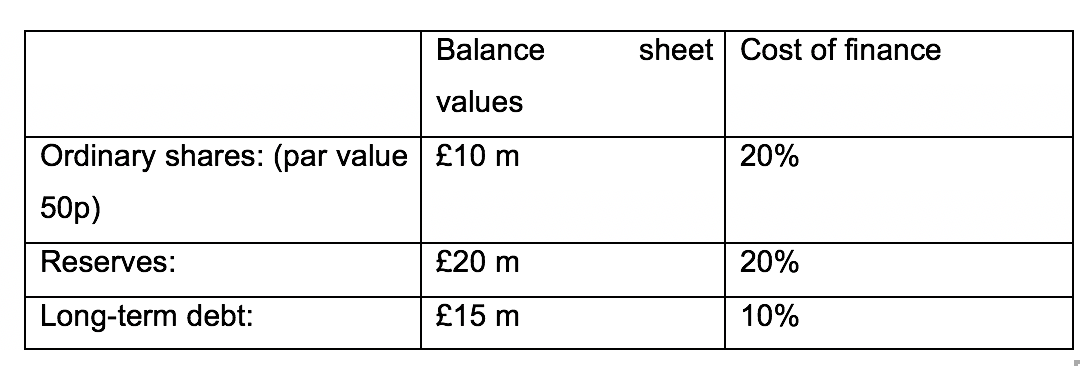

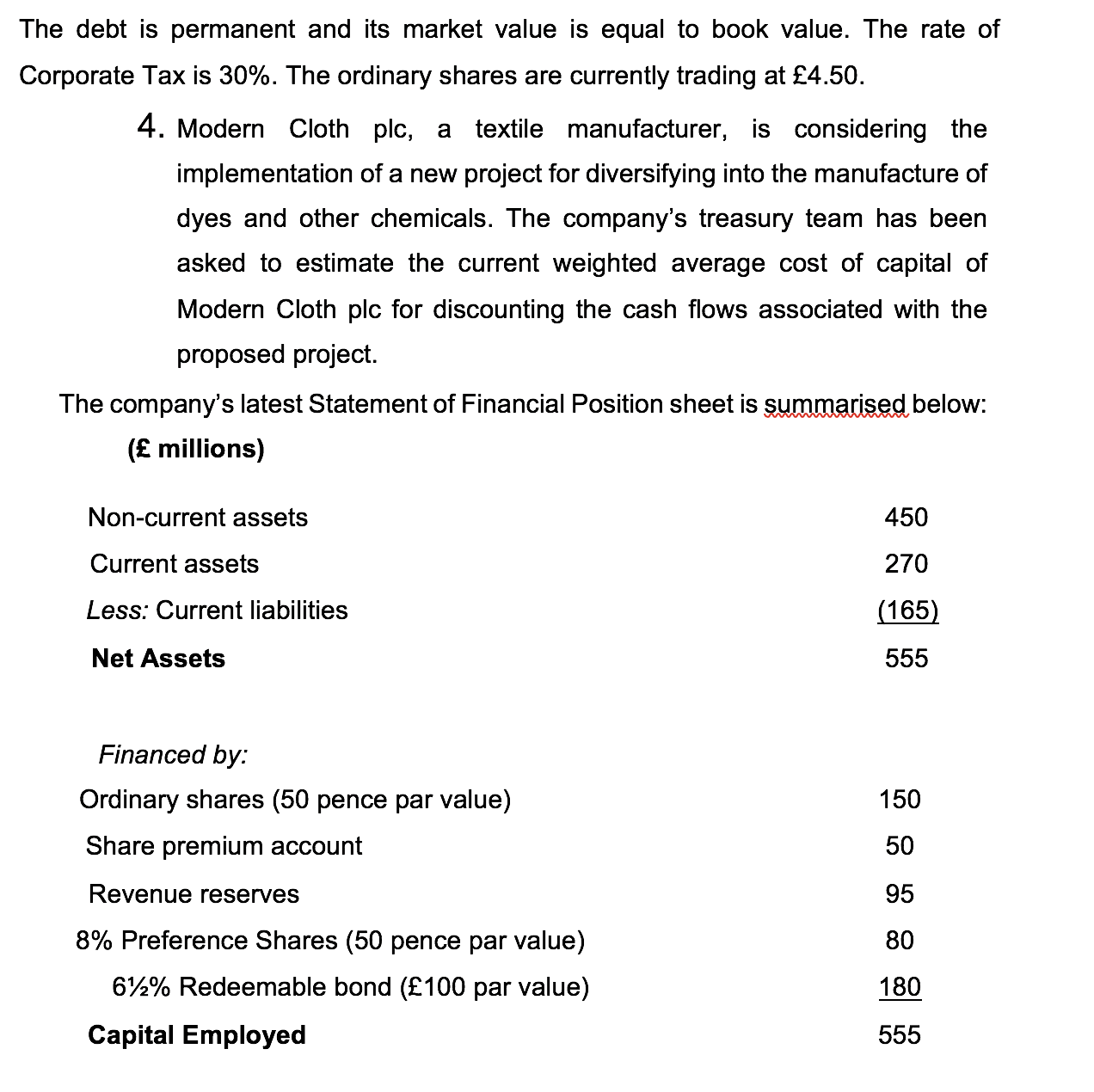

Question: Please explain all the questions step by step , make references to the theories and the formulas used. 1. ABC has the following capital structure,

Please explain all the questions step by step , make references to the theories and the formulas used.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts