Question: Please explain all work in full. Steps by financial calculator are fine Waterdeep Adventure Travel has an unlevered cost of equity of 19.5%, and a

Please explain all work in full.

Steps by financial calculator are fine

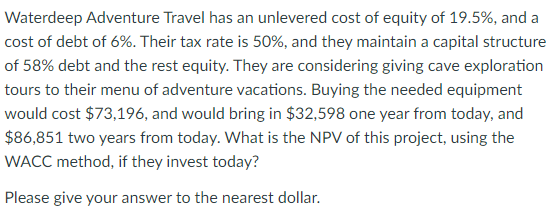

Waterdeep Adventure Travel has an unlevered cost of equity of 19.5%, and a cost of debt of 6%. Their tax rate is 50%, and they maintain a capital structure of 58% debt and the rest equity. They are considering giving cave exploration tours to their menu of adventure vacations. Buying the needed equipment would cost $73,196, and would bring in $32,598 one year from today, and $86,851 two years from today. What is the NPV of this project, using the WACC method, if they invest today? Please give your answer to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts