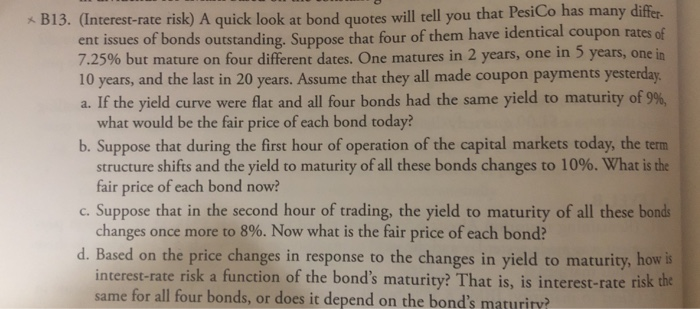

Question: Please explain also using the BA II plus calculator x B13. (Interest-rate risk) A quick look at bond quotes will tell you that PesiCo has

x B13. (Interest-rate risk) A quick look at bond quotes will tell you that PesiCo has many differ. nds outstanding Suppose that four of them have identical coupon rates of 7.25% but mature on four different dates. One matures in 2 years, one in 5 years, one in a. If the yield curve were flat and all four bonds had the same yield to maturity of 9%, b. Suppose that during the first hour of operation of the capital markets today, the term 10 years, and the last in 20 years. Assume that they all made coupon payments yesterday what would be the fair price of each bond today? structure shifts and the yield to maturity of all these bonds changes to 10%. What is the c. Suppose that in the second hour of trading, the yield to maturity of all these bonds d. Based on the price changes in response to the changes in yield to maturity, how is fair price of each bond now? changes once more to 8%. Now what is the fair price of each bond? same for all four bonds, or does it depend on the bond's maturiry? interest-rate risk a function of the bond's maturity? That is, is interest-rate risk the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts