Question: Please explain and answer. Thanks!! The following represents selected information taken from a company's aging of accounts receivable schedule to erestimate uncollectible accounts receivable at

Please explain and answer. Thanks!!

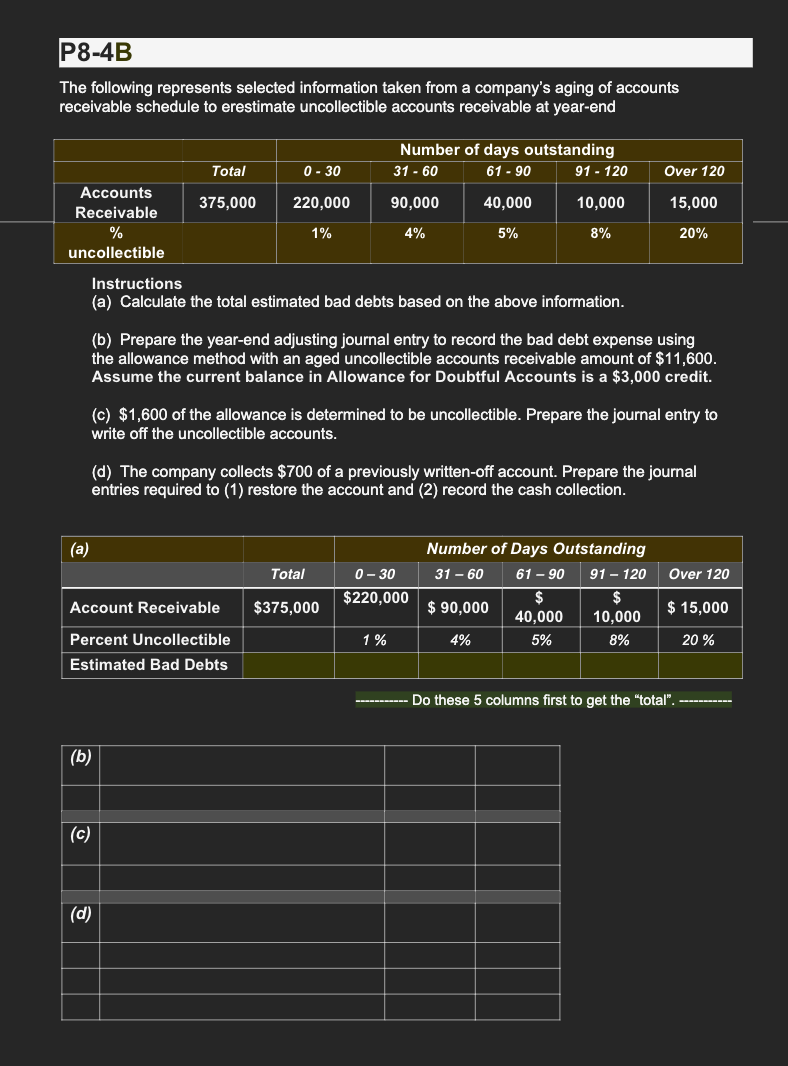

The following represents selected information taken from a company's aging of accounts receivable schedule to erestimate uncollectible accounts receivable at year-end Instructions (a) Calculate the total estimated bad debts based on the above information. (b) Prepare the year-end adjusting journal entry to record the bad debt expense using the allowance method with an aged uncollectible accounts receivable amount of $11,600. Assume the current balance in Allowance for Doubtful Accounts is a $3,000 credit. (c) $1,600 of the allowance is determined to be uncollectible. Prepare the journal entry to write off the uncollectible accounts. (d) The company collects $700 of a previously written-off account. Prepare the journal entries required to (1) restore the account and (2) record the cash collection. Do these 5 columns first to get the "total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts