Question: Please explain and include excel formulas 2 points What is the Sharpe ratio of the portfolio containing 40% SPDR and 60% Retail? Type your answer...

Please explain and include excel formulas

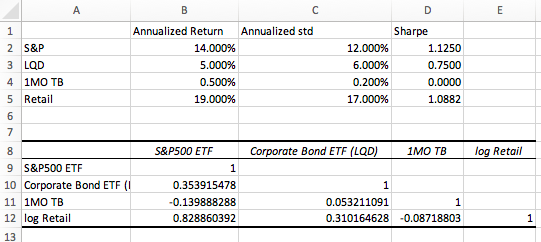

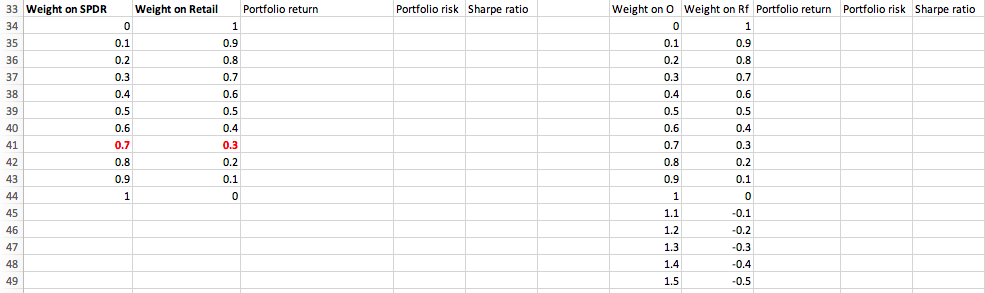

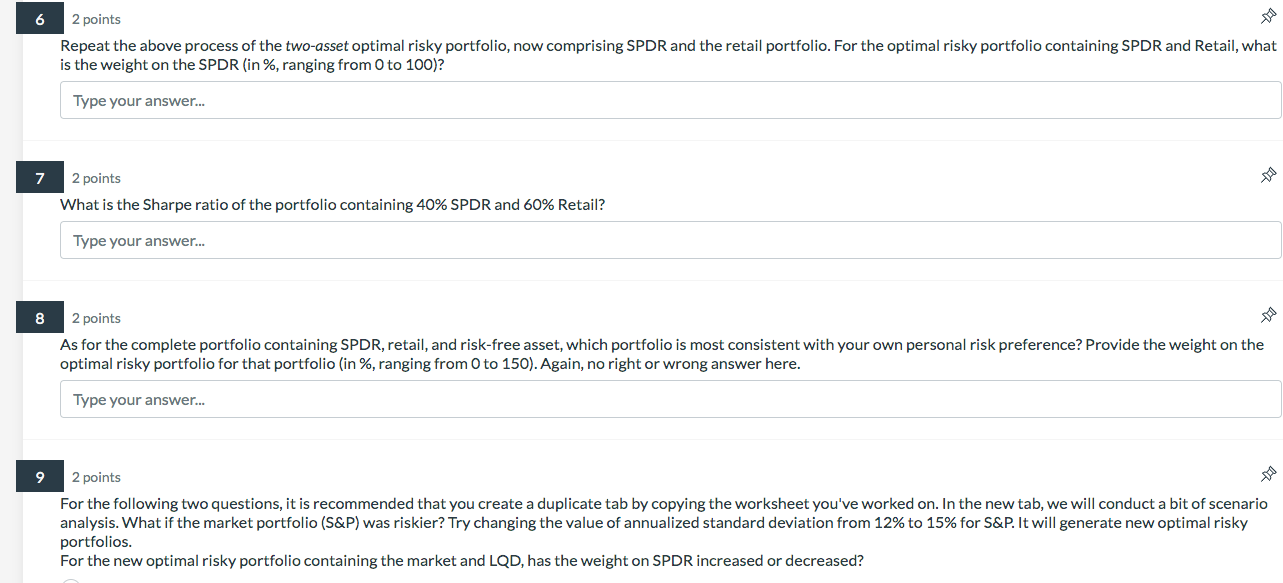

2 points What is the Sharpe ratio of the portfolio containing 40% SPDR and 60% Retail? Type your answer... 2 points As for the complete portfolio containing SPDR, retail, and risk-free asset, which portfolio is most consistent with your own personal risk preference? Provide the weight on the optimal risky portfolio for that portfolio (in \%, ranging from 0 to 150). Again, no right or wrong answer here. Type your answer... 2 points For the following two questions, it is recommended that you create a duplicate tab by copying the worksheet you've worked on. In the new tab, we will conduct a bit of scenario analysis. What if the market portfolio (S\&P) was riskier? Try changing the value of annualized standard deviation from 12% to 15% for S\&P. It will generate new optimal risky portfolios. For the new optimal risky portfolio containing the market and LQD, has the weight on SPDR increased or decreased? 2 points What is the Sharpe ratio of the portfolio containing 40% SPDR and 60% Retail? Type your answer... 2 points As for the complete portfolio containing SPDR, retail, and risk-free asset, which portfolio is most consistent with your own personal risk preference? Provide the weight on the optimal risky portfolio for that portfolio (in \%, ranging from 0 to 150). Again, no right or wrong answer here. Type your answer... 2 points For the following two questions, it is recommended that you create a duplicate tab by copying the worksheet you've worked on. In the new tab, we will conduct a bit of scenario analysis. What if the market portfolio (S\&P) was riskier? Try changing the value of annualized standard deviation from 12% to 15% for S\&P. It will generate new optimal risky portfolios. For the new optimal risky portfolio containing the market and LQD, has the weight on SPDR increased or decreased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts