Question: please explain and please explain the calculation as well. thank you QUESTION 2 (25 MARKS) A company receives a 20% grant to acquire a new

please explain and please explain the calculation as well. thank you

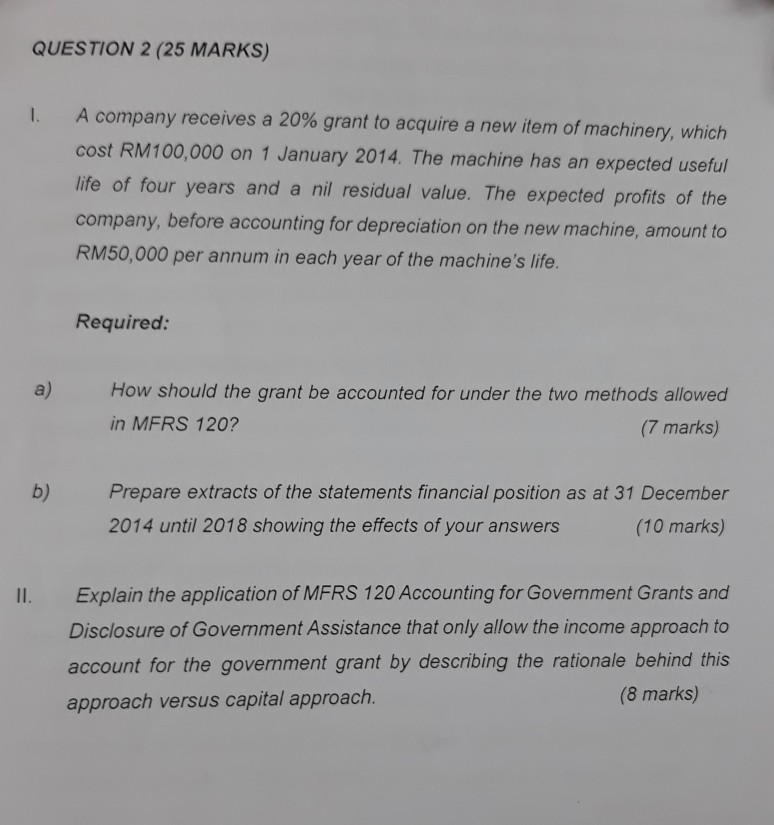

QUESTION 2 (25 MARKS) A company receives a 20% grant to acquire a new item of machinery, which cost RM100,000 on 1 January 2014. The machine has an expected useful life of four years and a nil residual value. The expected profits of the company, before accounting for depreciation on the new machine, amount to RM50,000 per annum in each year of the machine's life. Required: a) How should the grant be accounted for under the two methods allowed in MERS 120? (7 marks) b) Prepare extracts of the statements financial position as at 31 December 2014 until 2018 showing the effects of your answers (10 marks) II. Explain the application of MFRS 120 Accounting for Government Grants and Disclosure of Government Assistance that only allow the income approach to account for the government grant by describing the rationale behind this approach versus capital approach. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts