Question: please explain and post so that half the answer isnt cut off! thank you! Entries for Costs in a Job Order Cost System Velasco Co.

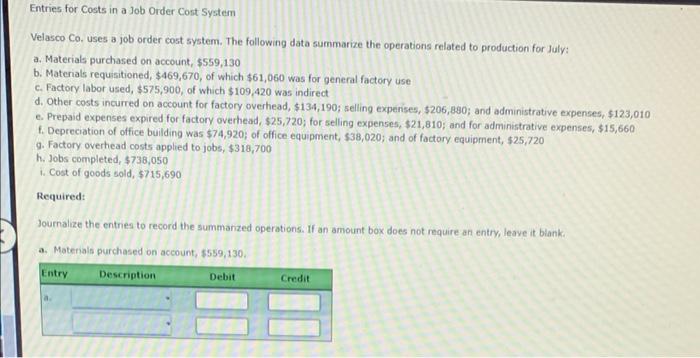

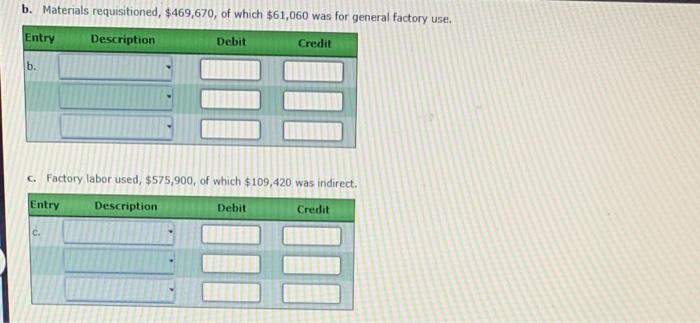

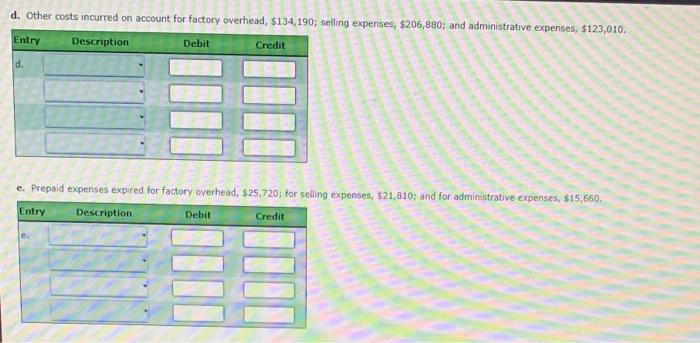

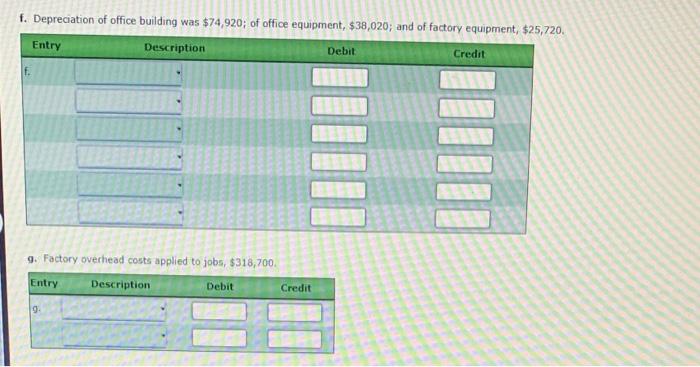

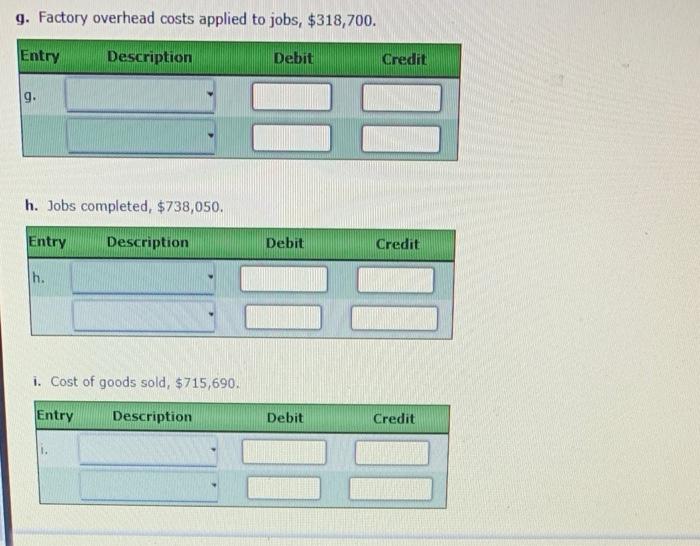

Entries for Costs in a Job Order Cost System Velasco Co. uses a job order cost system. The following data summarize the operations related to production for July: a. Materials purchased on account, $559,130 b. Materials requisitioned, $469,670, of which $61,060 was for general factory use c. Factory labor used, $575,900, of which $109,420 was indirect d. Other costs incurred on account for factory overhead, $134,190; selling expenses, $206,880; and administrative expenses, $123,010 c. Prepaid expenses expired for factory overhead, $25,720; for selling expenses, $21,810; and for administrative expenses $15,660 f. Depreciation of office building was $74,920; of office equipment, $38,020; and of factory equipment, $25,720 9. Factory overhead costs applied to jobs, $318,700 h. Jobs completed, $738,050 1. Cost of goods sold, $715,690 Required: Journalize the entries to record the summarzed operations. If an amount box does not require an entry, leave it blank. a. Materials purchased on account, $559,130. Entry Description Credit Debit b. Materials requisitioned, $469,670, of which $61,060 was for general factory use. Entry Description Debit Credit b. c. Factory labor used, $575,900, of which $109,420 was indirect. Entry Description Debit Credit d. Other costs incurred on account for factory overhead, $134,190; selling expenses, $206,880; and administrative expenses, $123,010. Entry Description Debit Credit d. e Prepaid expenses expired for factory overhead, $25,720, for selling expenses, $21,810; and for administrative expenses, $15.660. Entry Description Debit Credit f. Depreciation of office building was $74,920; of office equipment, $38,020; and of factory equipment, $25,720 Entry Description Debit Credit f. 9. Factory overhead costs applied to jobs, $318,700. Entry Description Debit Credit 9 g. Factory overhead costs applied to jobs, $318,700. Entry Description Debit Credit 9 h. Jobs completed, $738,050. Entry Description Debit Credit h. i. Cost of goods sold, $715,690. Entry Description Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts