Question: Please explain and show all the working out. a) What is the price of a European call option on the stock of Company Z when

Please explain and show all the working out.

a) What is the price of a European call option on the stock of Company Z when the current stock price is $50, the strike price is $48, the risk-free rate is 12% continuously compounded, the standard deviation of stock returns is 30%, and the time to maturity is six months? Company Z is not expected to pay any dividend between now and the expiry date

c) What is Sophias expectation of the share price of Company X, given her investment strategy?

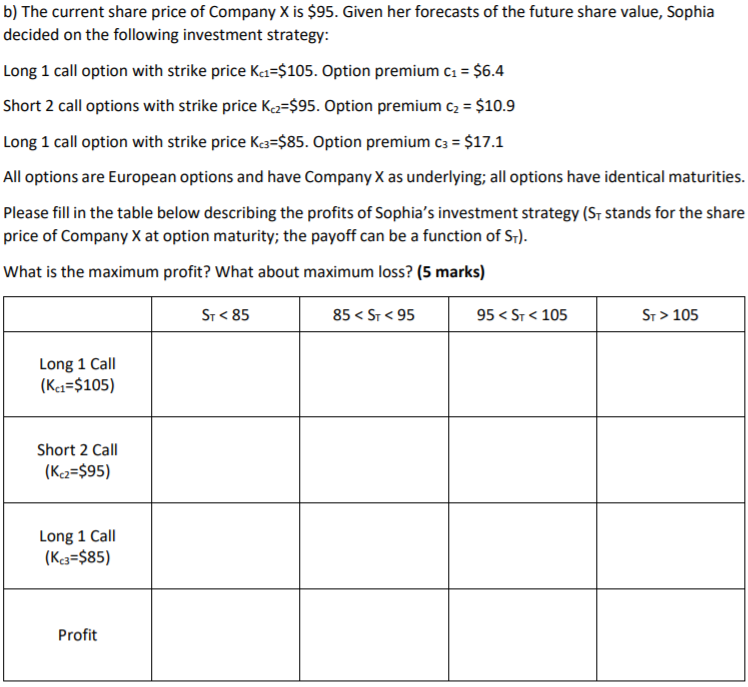

b) The current share price of Company X is $95. Given her forecasts of the future share value, Sophia decided on the following investment strategy: Long 1 call option with strike price Kc1=$105. Option premium C1 = $6.4 Short 2 call options with strike price Kez=$95. Option premium cz = $10.9 Long 1 call option with strike price K3=$85. Option premium C3 = $17.1 All options are European options and have company X as underlying; all options have identical maturities. Please fill in the table below describing the profits of Sophia's investment strategy (St stands for the share price of Company X at option maturity; the payoff can be a function of St). What is the maximum profit? What about maximum loss? (5 marks) ST 105 Long 1 Call (Ka=$105) Short 2 Call (Kc2=$95) Long 1 Call (Kcs=$85) Profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts