Question: Please explain and show all working In order to study an investment portfolio, you consider the following model R = bo + bA+bB+ , where

Please explain and show all working

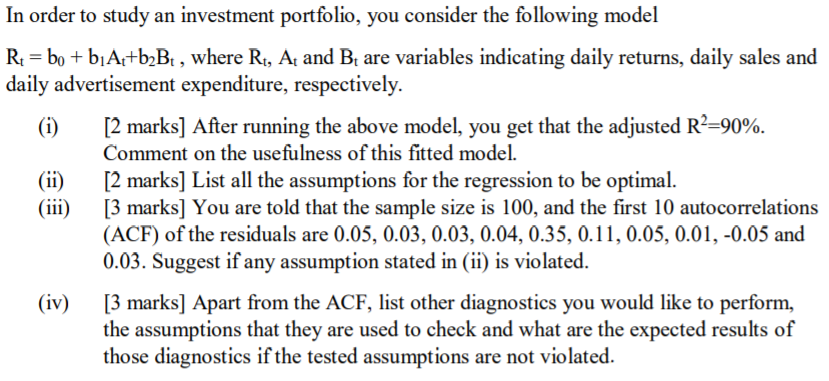

In order to study an investment portfolio, you consider the following model R = bo + bA+bB+ , where Rt, A and B are variables indicating daily returns, daily sales and daily advertisement expenditure, respectively. (i) [2 marks] After running the above model, you get that the adjusted R2=90%. Comment on the usefulness of this fitted model. [2 marks] List all the assumptions for the regression to be optimal. [3 marks] You are told that the sample size is 100, and the first 10 autocorrelations (ACF) of the residuals are 0.05, 0.03, 0.03, 0.04, 0.35, 0.11, 0.05, 0.01, -0.05 and 0.03. Suggest if any assumption stated in (ii) is violated. (iii) (iv) [3 marks] Apart from the ACF, list other diagnostics you would like to perform, the assumptions that they are used to check and what are the expected results of those diagnostics if the tested assumptions are not violated. In order to study an investment portfolio, you consider the following model R = bo + bA+bB+ , where Rt, A and B are variables indicating daily returns, daily sales and daily advertisement expenditure, respectively. (i) [2 marks] After running the above model, you get that the adjusted R2=90%. Comment on the usefulness of this fitted model. [2 marks] List all the assumptions for the regression to be optimal. [3 marks] You are told that the sample size is 100, and the first 10 autocorrelations (ACF) of the residuals are 0.05, 0.03, 0.03, 0.04, 0.35, 0.11, 0.05, 0.01, -0.05 and 0.03. Suggest if any assumption stated in (ii) is violated. (iii) (iv) [3 marks] Apart from the ACF, list other diagnostics you would like to perform, the assumptions that they are used to check and what are the expected results of those diagnostics if the tested assumptions are not violated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts