Question: please explain and show formulas what do you mean ? all the information is there You are the sole bondholder in a firm that will

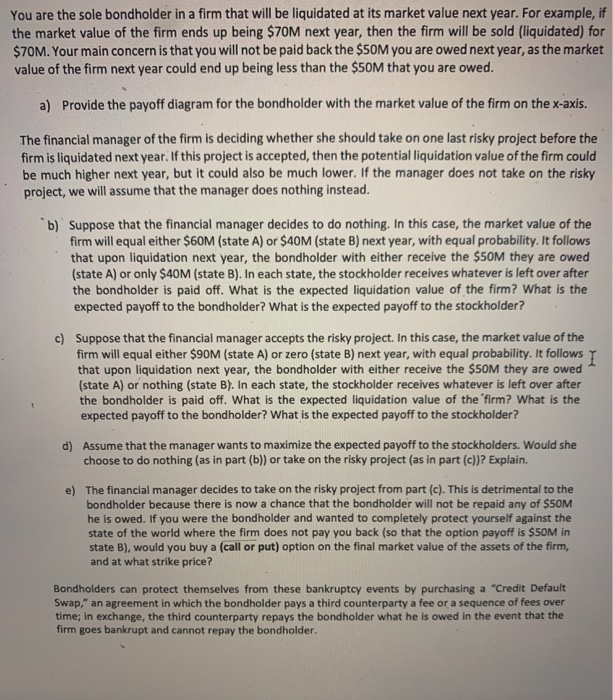

You are the sole bondholder in a firm that will be liquidated at its market value next year. For example, if the market value of the firm ends up being $70M next year, then the firm will be sold (liquidated) for $70M. Your main concern is that you will not be paid back the $50M you are owed next year, as the market value of the firm next year could end up being less than the $50M that you are owed. a) Provide the payoff diagram for the bondholder with the market value of the firm on the x-axis. The financial manager of the firm is deciding whether she should take on one last risky project before the firm is liquidated next year. If this project is accepted, then the potential liquidation value of the firm could be much higher next year, but it could also be much lower. If the manager does not take on the risky project, we will assume that the manager does nothing instead. b) Suppose that the financial manager decides to do nothing. In this case, the market value of the firm will equal either $60M (state A) or $40M (state B) next year, with equal probability. It follows that upon liquidation next year, the bondholder with either receive the $50M they are owed (state A) or only $40M (state B). In each state, the stockholder receives whatever is left over after the bondholder is paid off. What is the expected liquidation value of the firm? What is the expected payoff to the bondholder? What is the expected payoff to the stockholder? c) Suppose that the financial manager accepts the risky project. In this case, the market value of the firm will equal either $90M (state A) or zero (state B) next year, with equal probability. It follows I that upon liquidation next year, the bondholder with either receive the $50M they are owed (state A) or nothing (state B). In each state, the stockholder receives whatever is left over after the bondholder is paid off. What is the expected liquidation value of the firm? What is the expected payoff to the bondholder? What is the expected payoff to the stockholder? d) Assume that the manager wants to maximize the expected payoff to the stockholders. Would she choose to do nothing (as in part (b)) or take on the risky project (as in part (c))? Explain. e) The financial manager decides to take on the risky project from part (c). This is detrimental to the bondholder because there is now a chance that the bondholder will not be repaid any of $50M he is owed. If you were the bondholder and wanted to completely protect yourself against the state of the world where the firm does not pay you back (so that the option payoff is $50M in state B), would you buy a (call or put) option on the final market value of the assets of the firm, and at what strike price? Bondholders can protect themselves from these bankruptcy events by purchasing a "Credit Default Swap," an agreement in which the bondholder pays a third counterparty a fee or a sequence of fees over time; in exchange, the third counterparty repays the bondholder what he is owed in the event that the firm goes bankrupt and cannot repay the bondholder. You are the sole bondholder in a firm that will be liquidated at its market value next year. For example, if the market value of the firm ends up being $70M next year, then the firm will be sold (liquidated) for $70M. Your main concern is that you will not be paid back the $50M you are owed next year, as the market value of the firm next year could end up being less than the $50M that you are owed. a) Provide the payoff diagram for the bondholder with the market value of the firm on the x-axis. The financial manager of the firm is deciding whether she should take on one last risky project before the firm is liquidated next year. If this project is accepted, then the potential liquidation value of the firm could be much higher next year, but it could also be much lower. If the manager does not take on the risky project, we will assume that the manager does nothing instead. b) Suppose that the financial manager decides to do nothing. In this case, the market value of the firm will equal either $60M (state A) or $40M (state B) next year, with equal probability. It follows that upon liquidation next year, the bondholder with either receive the $50M they are owed (state A) or only $40M (state B). In each state, the stockholder receives whatever is left over after the bondholder is paid off. What is the expected liquidation value of the firm? What is the expected payoff to the bondholder? What is the expected payoff to the stockholder? c) Suppose that the financial manager accepts the risky project. In this case, the market value of the firm will equal either $90M (state A) or zero (state B) next year, with equal probability. It follows I that upon liquidation next year, the bondholder with either receive the $50M they are owed (state A) or nothing (state B). In each state, the stockholder receives whatever is left over after the bondholder is paid off. What is the expected liquidation value of the firm? What is the expected payoff to the bondholder? What is the expected payoff to the stockholder? d) Assume that the manager wants to maximize the expected payoff to the stockholders. Would she choose to do nothing (as in part (b)) or take on the risky project (as in part (c))? Explain. e) The financial manager decides to take on the risky project from part (c). This is detrimental to the bondholder because there is now a chance that the bondholder will not be repaid any of $50M he is owed. If you were the bondholder and wanted to completely protect yourself against the state of the world where the firm does not pay you back (so that the option payoff is $50M in state B), would you buy a (call or put) option on the final market value of the assets of the firm, and at what strike price? Bondholders can protect themselves from these bankruptcy events by purchasing a "Credit Default Swap," an agreement in which the bondholder pays a third counterparty a fee or a sequence of fees over time; in exchange, the third counterparty repays the bondholder what he is owed in the event that the firm goes bankrupt and cannot repay the bondholder

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts