Question: Please explain and show the calculation that how to get those answers for question 1,2,4 and 6. 1. Metal Parts Ltd is considering eliminating its

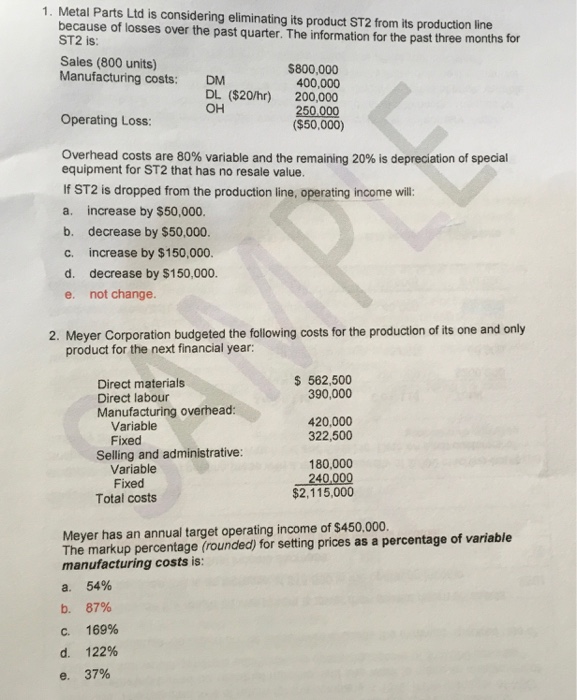

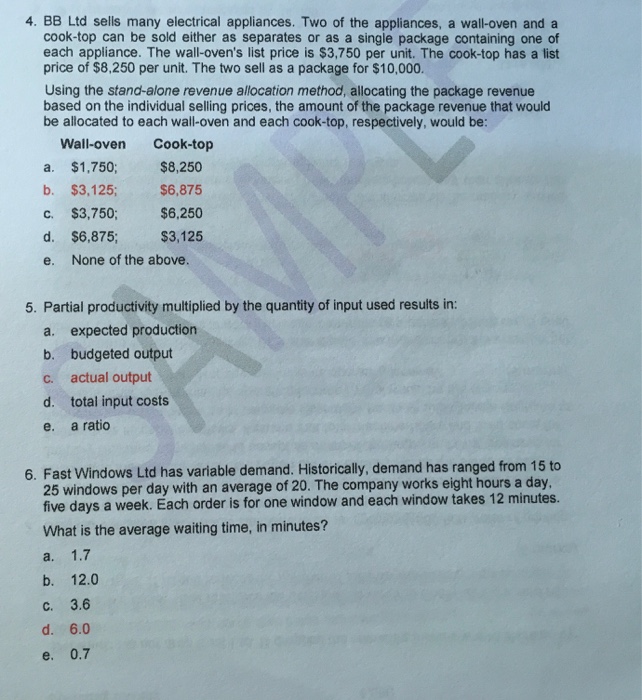

1. Metal Parts Ltd is considering eliminating its product ST2 from its production line because of losses over the past quarter. The information for the past three months for is Sales (800 units) $800,000 Manufacturing costs DM 400,000 DL ($20/hr) 200,000 OH 50 operating Loss ($50,000) Overhead costs are 80% variable and the remaining 20% is depreciation of special equipment for ST2 that has no resale value. If ST2 is dropped from the production line, operating income will: a. increase by $50,000. b. decrease by $50,000. c. ncrease by $150,000 d. decrease by $150,000. e, not change. 2. Meyer Corporation budgeted the following costs for the production of its one and only product for the next financial year: 562,500 Direct materials 390,000 Direct labour Manufacturing overhead 420,000 Variable 322,500 Fixed Selling and administrative: 180.000 Variable 240,000 Fixed $2,115,000 Total costs Meyer has an annual target operating income of $450,000. of variable The markup (rounded) for setting prices as a percentage manufacturing costs is: a. 54% b, 87% c. 169% d. 122% e. 37%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts