Question: Please explain and show the formula you used for each cell Question Starts Here: Fill the highlighted cells up and add additional inputs / outputs

Please explain and show the formula you used for each cell

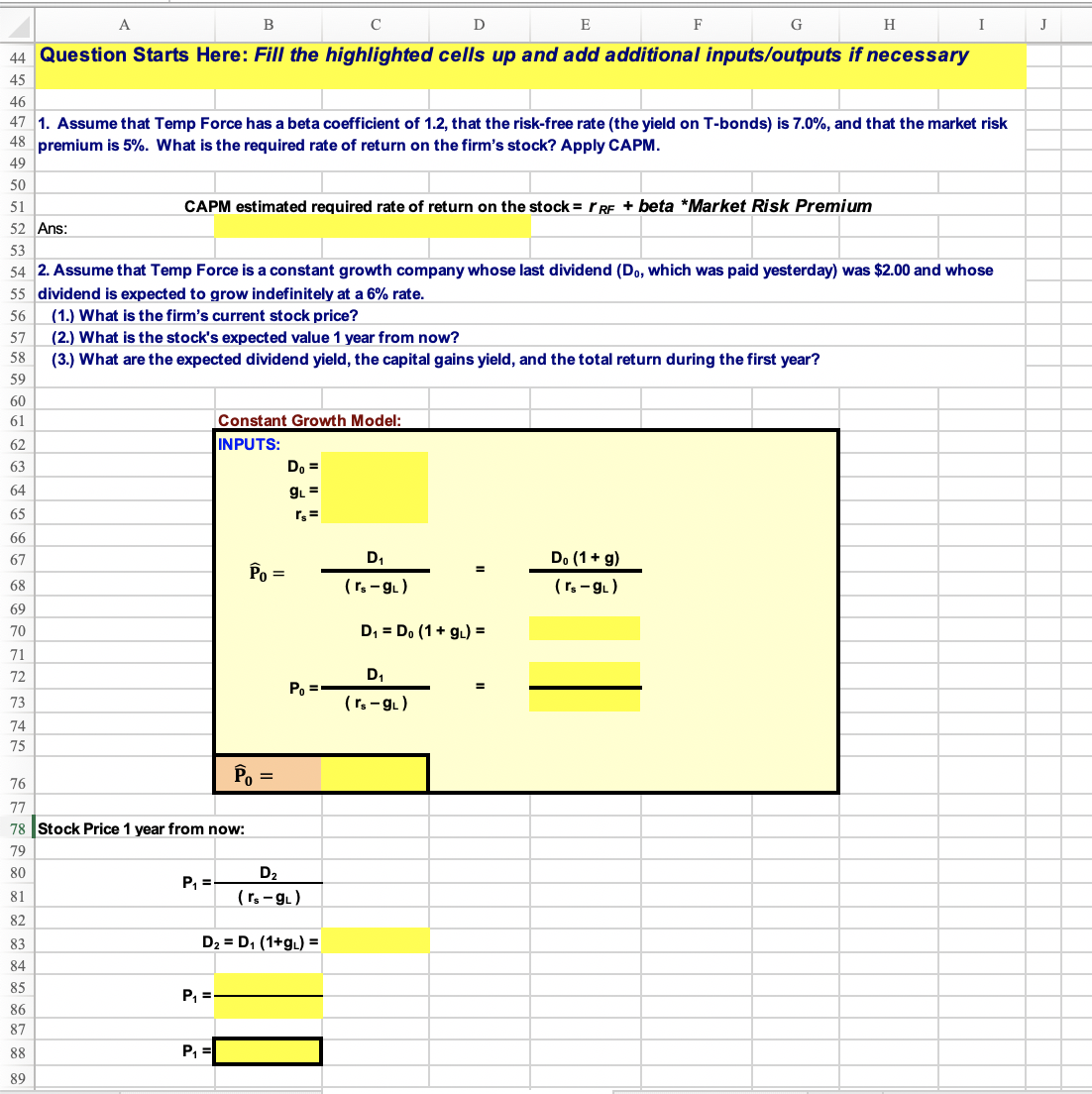

Question Starts Here: Fill the highlighted cells up and add additional inputsoutputs if necessary

Assume that Temp Force has a beta coefficient of that the riskfree rate the yield on Tbonds is and that the market risk

premium is What is the required rate of return on the firm's stock? Apply CAPM.

CAPM estimated required rate of return on the stock beta Market Risk Premium

Ans:

Assume that Temp Force is a constant growth company whose last dividend which was paid yesterday was $ and whose

dividend is expected to grow indefinitely at a rate.

What is the firm's current stock price?

What is the stock's expected value year from now?

What are the expected dividend yield, the capital gains yield, and the total return during the first year?

Constant Growth Model:

INPUTS:

widehat

Stock Price year from now:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock