Question: please explain and show the formulas Question 1 (30 marks) The following information is obtained from a company's latest financial statements and other sources: $2

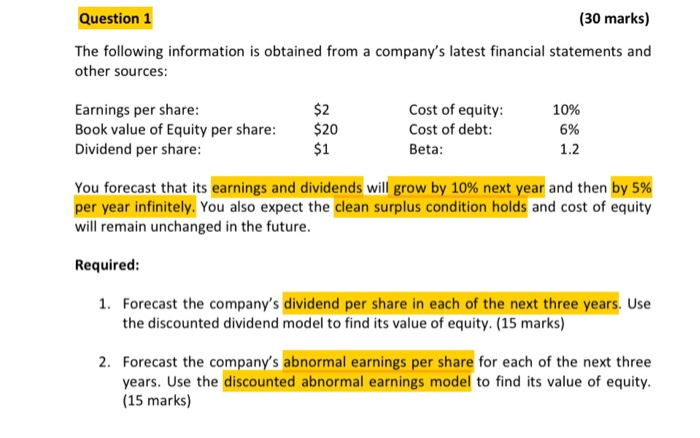

Question 1 (30 marks) The following information is obtained from a company's latest financial statements and other sources: $2 Earnings per share: Book value of Equity per share: Dividend per share: $20 $1 Cost of equity: Cost of debt: Beta: 10% 6% 1.2 You forecast that its earnings and dividends will grow by 10% next year and then by 5% per year infinitely. You also expect the clean surplus condition holds and cost of equity will remain unchanged in the future. Required: 1. Forecast the company's dividend per share in each of the next three years. Use the discounted dividend model to find its value of equity. (15 marks) 2. Forecast the company's abnormal earnings per share for each of the next three years. Use the discounted abnormal earnings model to find its value of equity. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts