Question: Please explain and show work. 1. The net present value (NPV) of the project (ACCEPT or REJECT from the drop-down box) 2. The internal rate

Please explain and show work.

Please explain and show work.

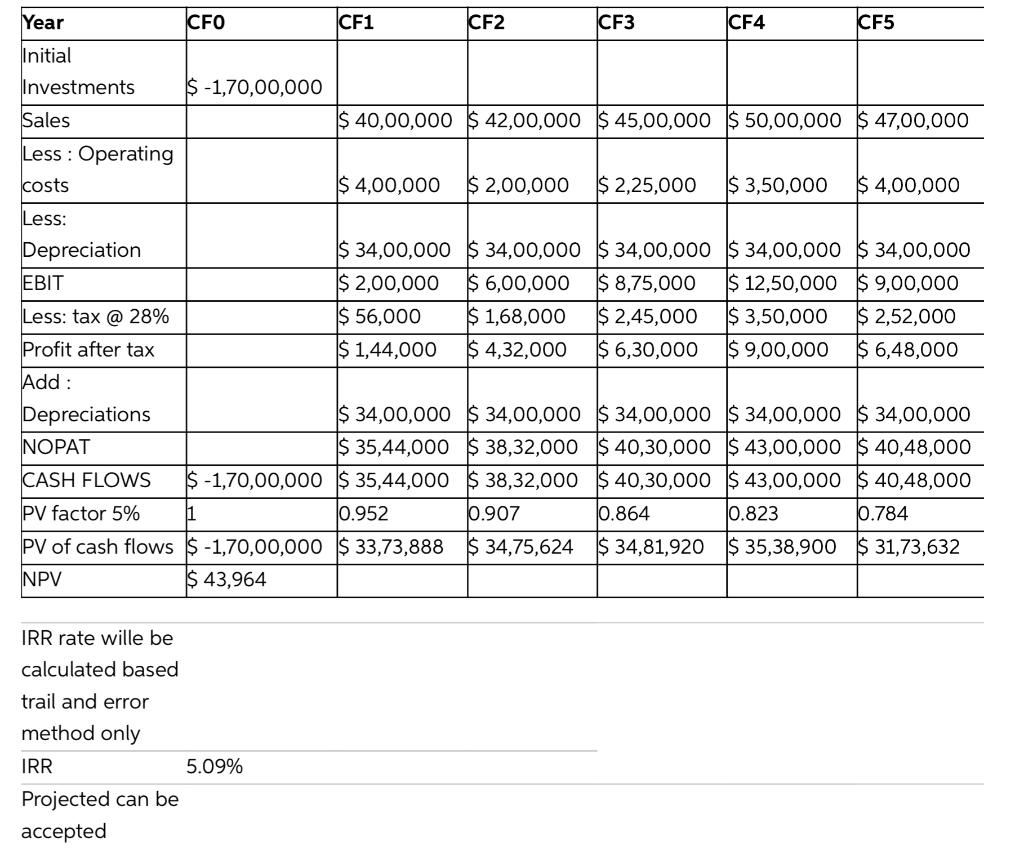

1. The net present value (NPV) of the project (ACCEPT or REJECT from the drop-down box) 2. The internal rate of return (IRR) of the project (ACCEPT or REJECT from the drop-down box) portfolio risk with return, would you recommend that the company pursue the investment? Why or why not? Be sure to substantiate your claims. C. What is the difference between NPV and IRR? Which one would you choose for evaluating a potential investment and why? Be sure to support your reasoning with evidence. \begin{tabular}{|l|l|l|l|l|l|l} \hline Year & CF0 & CF1 & CF2 & CF3 & CF4 & CF5 \\ \hline Initial Investments & $1,70,00,000 & & & & & \\ \hline Sales & & $40,00,000 & $42,00,000 & $45,00,000 & $50,00,000 & $47,00,000 \\ \hline Less : Operating costs & & & & & & \\ \hline Less: & & $4,00,000 & $2,00,000 & $2,25,000 & $3,50,000 & $4,00,000 \\ \hline Depreciation & & $34,00,000 & $34,00,000 & $34,00,000 & $34,00,000 & $34,00,000 \\ \hline EBIT & & $2,00,000 & $6,00,000 & $8,75,000 & $12,50,000 & $9,00,000 \\ \hline Less: tax @ 28\% & & $56,000 & $1,68,000 & $2,45,000 & $3,50,000 & $2,52,000 \\ \hline Profit after tax & & $1,44,000 & $4,32,000 & $6,30,000 & $9,00,000 & $6,48,000 \\ \hline Add : & & & & & & \\ \hline Depreciations & & $34,00,000 & $34,00,000 & $34,00,000 & $34,00,000 & $34,00,000 \\ \hline NOPAT & & $35,44,000 & $38,32,000 & $40,30,000 & $43,00,000 & $40,48,000 \\ \hline CASH FLOWS & $1,70,00,000 & $35,44,000 & $38,32,000 & $40,30,000 & $43,00,000 & $40,48,000 \\ \hline PV factor 5\% & 1 & 0.952 & 0.907 & 0.864 & 0.823 & 0.784 \\ \hline PV of cash flows & $1,70,00,000 & $33,73,888 & $34,75,624 & $34,81,920 & $35,38,900 & $31,73,632 \\ \hline NPV & $43,964 & & & & & \\ \hline \end{tabular} IRR rate wille be calculated based trail and error method only IRR 5.09% Projected can be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts