Question: Please explain and show work for how you get answer. 1 Capital Asset Pricing Model: Levine Manufacturing Inc. is considering several investments. The rate on

Please explain and show work for how you get answer.

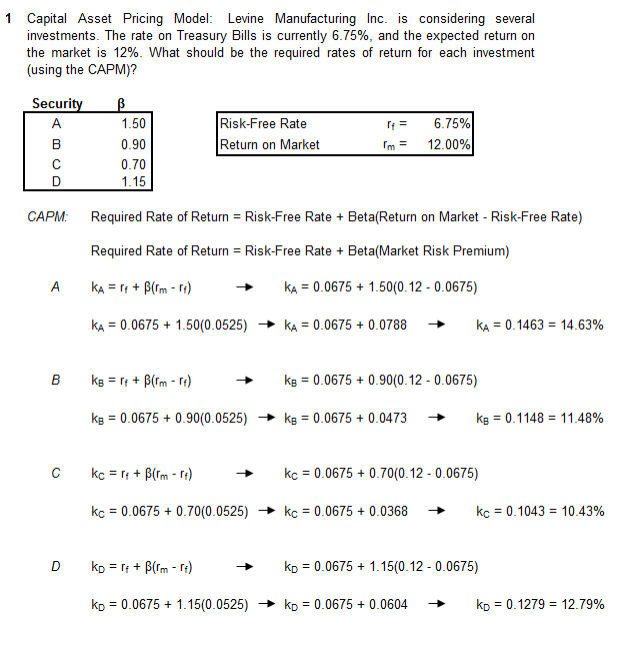

1 Capital Asset Pricing Model: Levine Manufacturing Inc. is considering several investments. The rate on Treasury Bills is currently 6.75%, and the expected return on the market is 12%. What should be the required rates of return for each investment (using the CAPM)? Security . B D B 1.50 0.90 0.70 1.15 Risk-Free Rate Return on Market 6.75% 12.00% CAPM Required Rate of Return = Risk-Free Rate + Beta(Return on Market - Risk-Free Rate) Required Rate of Return = Risk-Free Rate + Beta(Market Risk Premium) KA = 14 + Blom - It) KA = 0.0675 +1.50(0.12 - 0.0675) KA = 0.0675 + 1.50(0.0525) KA = 0.0675 +0.0788 KA = 0.1463 = 14.63% B kg = 14 + Blom - 11) kg = 0.0675 + 0.90(0.12 - 0.0675) kg = 0.0675 + 0.90(0.0525) kg = 0.0675 + 0.0473 kg = 0.1148 = 11.48% kc = 14 + Birm - It) kc = 0.0675 + 0.70(0.12 -0.0675) kc = 0.0675 +0.70(0.0525) kc = 0.0675 + 0.0368 kc = 0.1043 = 10.43% Dkp = pi + B(rm - It) kp = 0.0675 + 1.15(0.12 -0.0675) kp = 0.0675 + 1.15(0.0525) kp = 0.0675 + 0.0604 kp = 0.1279 = 12.79%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts