Question: Please explain and show work, will thumbs up. Thankyou. Use the following information calculate the option's price. You are analyzing a put option for Airbus's

Please explain and show work, will thumbs up. Thankyou.

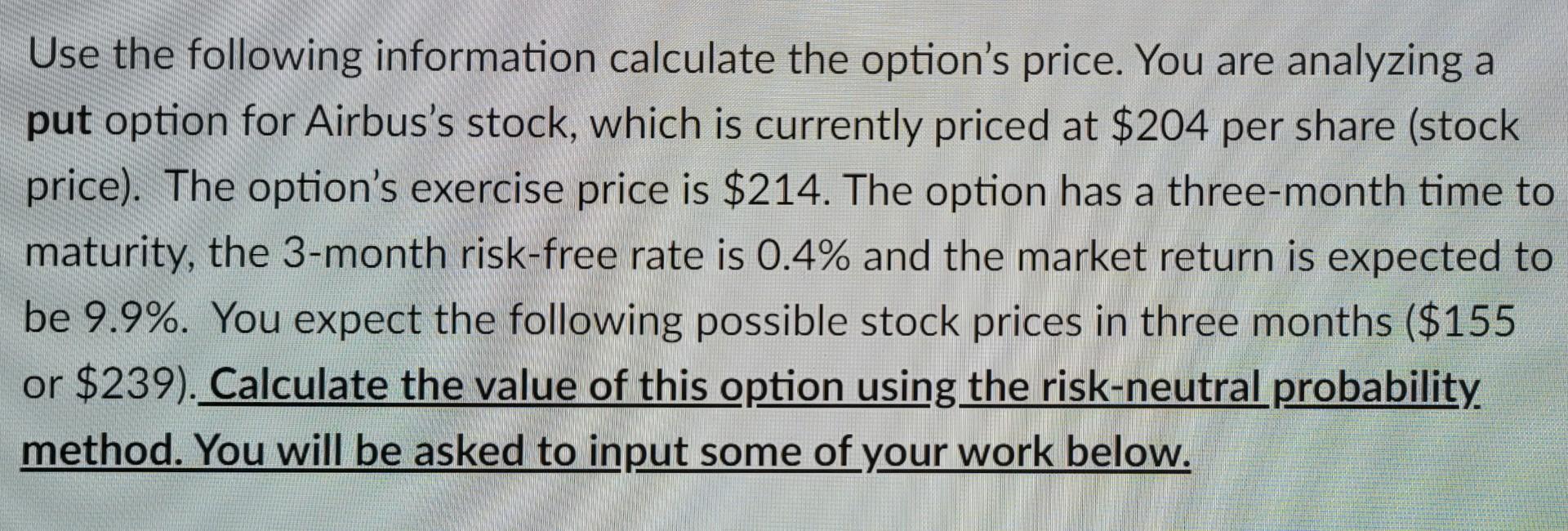

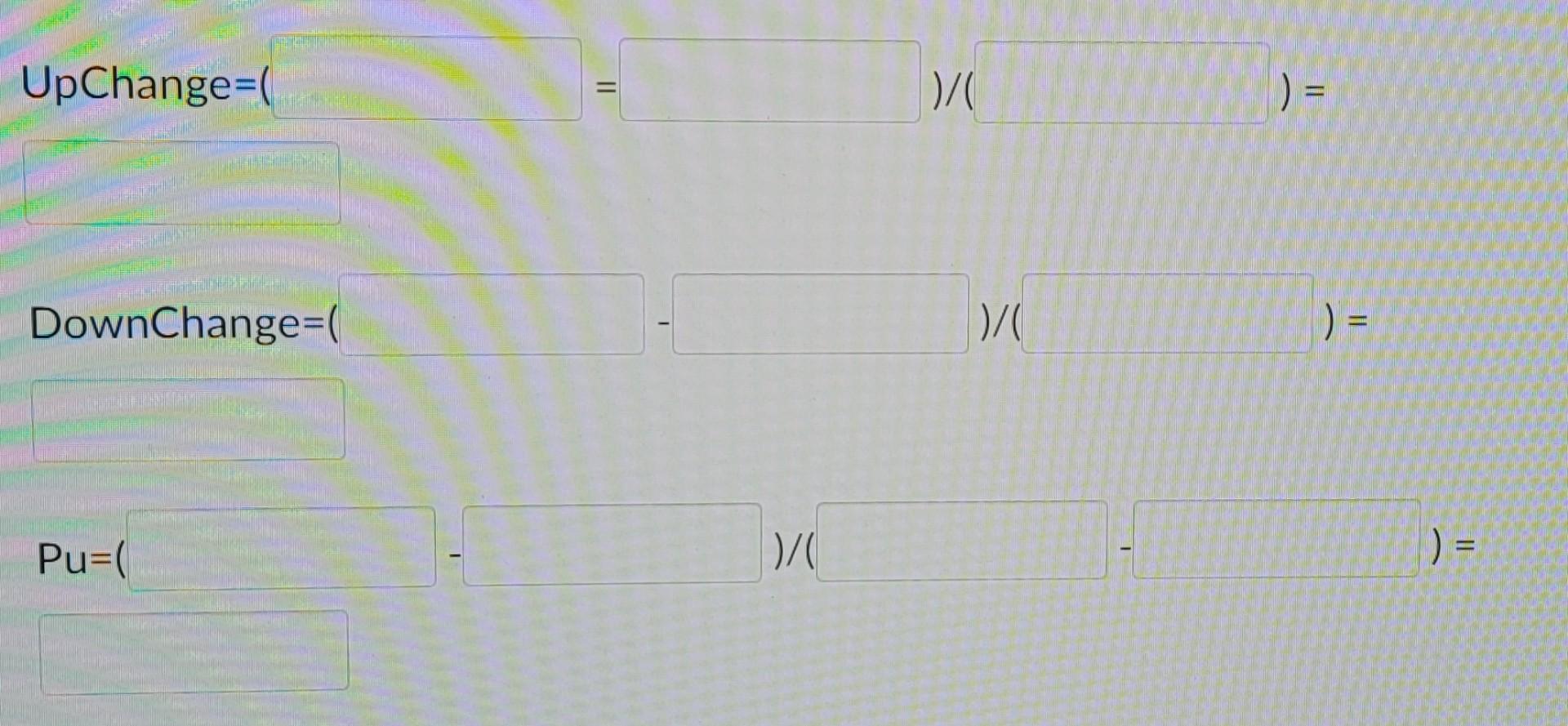

Use the following information calculate the option's price. You are analyzing a put option for Airbus's stock, which is currently priced at \$204 per share (stock price). The option's exercise price is $214. The option has a three-month time to maturity, the 3 -month risk-free rate is 0.4% and the market return is expected to be 9.9%. You expect the following possible stock prices in three months (\$155 or \$239). Calculate the value of this option using the risk-neutral probability. method. You will be asked to input some of your work below. DownChange =( Pu=(

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts