Question: Please explain and show your work Thanks! :) On September 30, 2020, Sustco Ltd. purchased a piece of equipment for $22,000. At the time, management

Please explain and show your work

Thanks!

:)

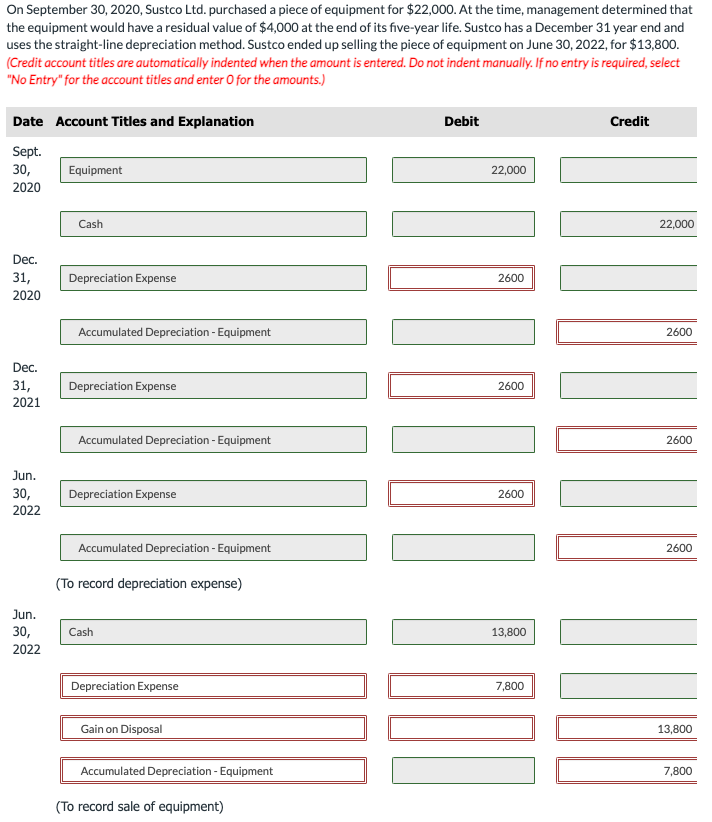

On September 30, 2020, Sustco Ltd. purchased a piece of equipment for $22,000. At the time, management determined that the equipment would have a residual value of $4,000 at the end of its five-year life. Sustco has a December 31 year end and uses the straight-line depreciation method. Sustco ended up selling the piece of equipment on June 30, 2022, for $13,800. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Sept. 30, 2020 Dec. 31, 2020 Dec. 31, 2021 Jun. 30, 2022 Jun. 30, 2022 Equipment Cash Depreciation Expense Accumulated Depreciation - Equipment Depreciation Expense Accumulated Depreciation - Equipment Depreciation Expense Accumulated Depreciation - Equipment (To record depreciation expense) Cash Depreciation Expense Gain on Disposal Accumulated Depreciation - Equipment (To record sale of equipment) Debit 22,000 2600 2600 2600 13,800 7,800 Credit 22,000 2600 2600 2600 13,800 7,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts