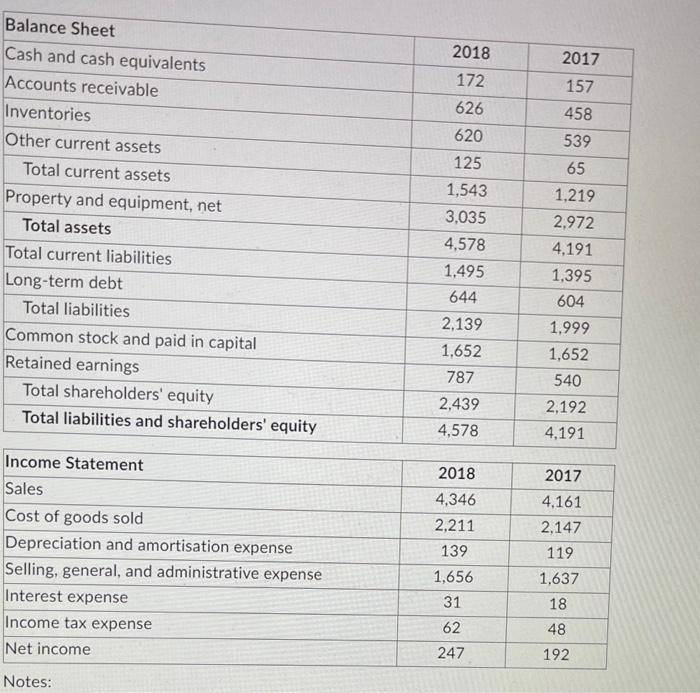

Question: please explain Balance Sheet Notes: 1), The LIFO reserves as of 31 December 2018 and 2017 are $155 million and $117 million respectively, and 2),

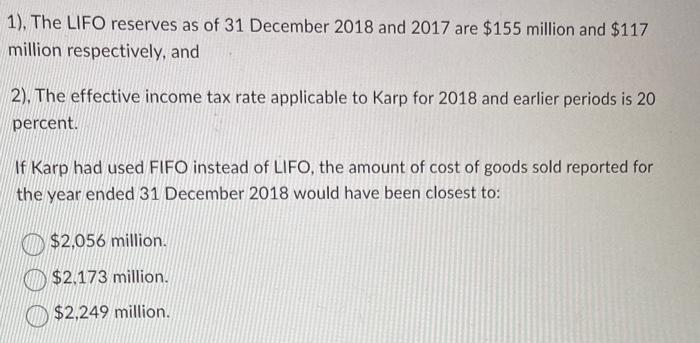

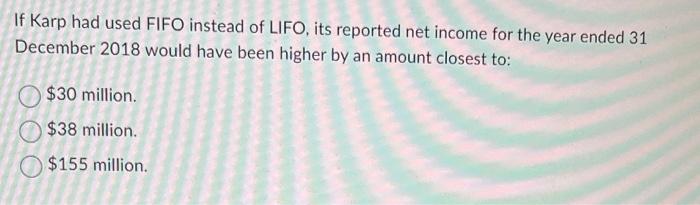

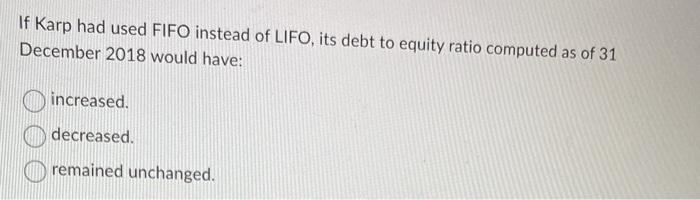

Balance Sheet Notes: 1), The LIFO reserves as of 31 December 2018 and 2017 are $155 million and $117 million respectively, and 2), The effective income tax rate applicable to Karp for 2018 and earlier periods is 20 percent. If Karp had used FIFO instead of LIFO, the amount of cost of goods sold reported for the year ended 31 December 2018 would have been closest to: $2,056 million. $2,173 million. $2,249 million. If Karp had used FIFO instead of LIFO, its reported net income for the year ended 31 December 2018 would have been higher by an amount closest to: $30 million. $38 million. $155 million. If Karp had used FIFO instead of LIFO, its debt to equity ratio computed as of 31 December 2018 would have: increased. decreased. remained unchanged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts