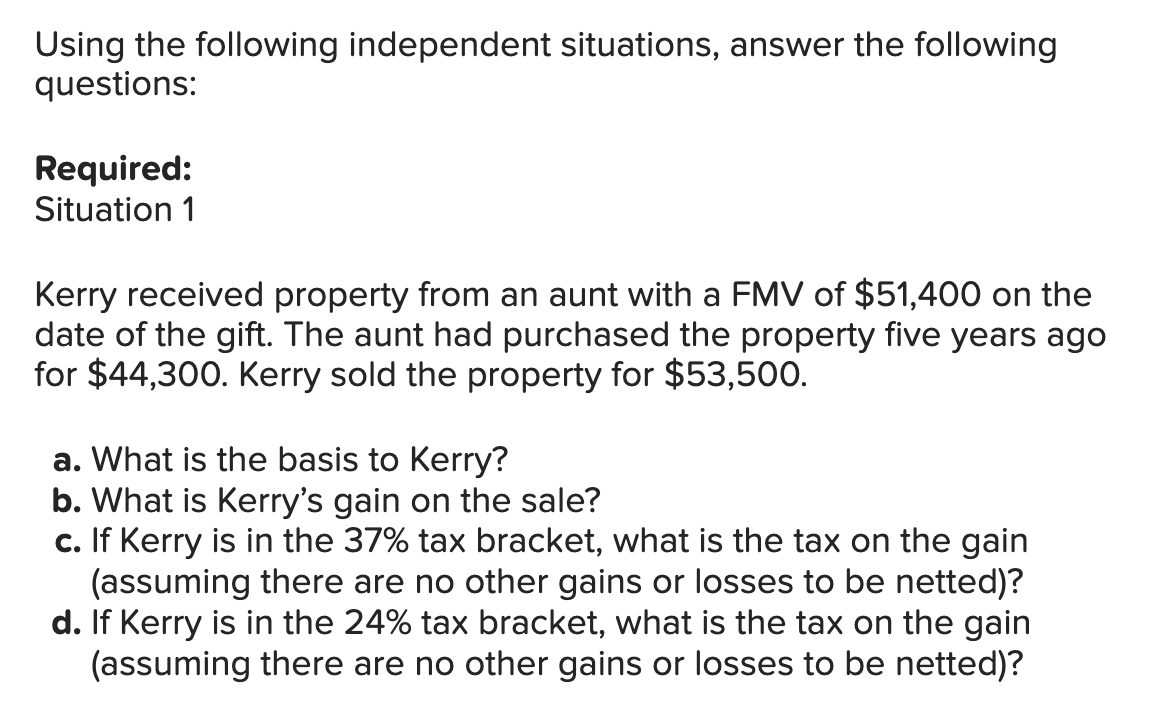

Question: Please explain. begin{tabular}{|l|l|} hline & multicolumn{1}{|c|}{ Amounts } hline a. Basis of the property & hline b. Gain on sale & hline

Please explain.

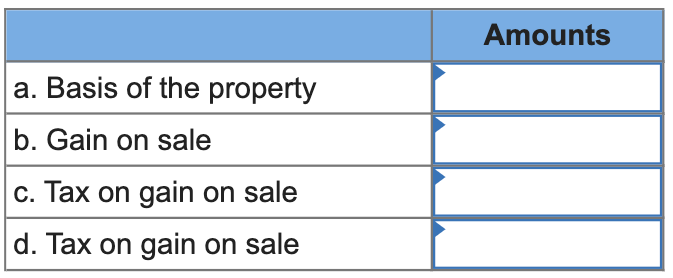

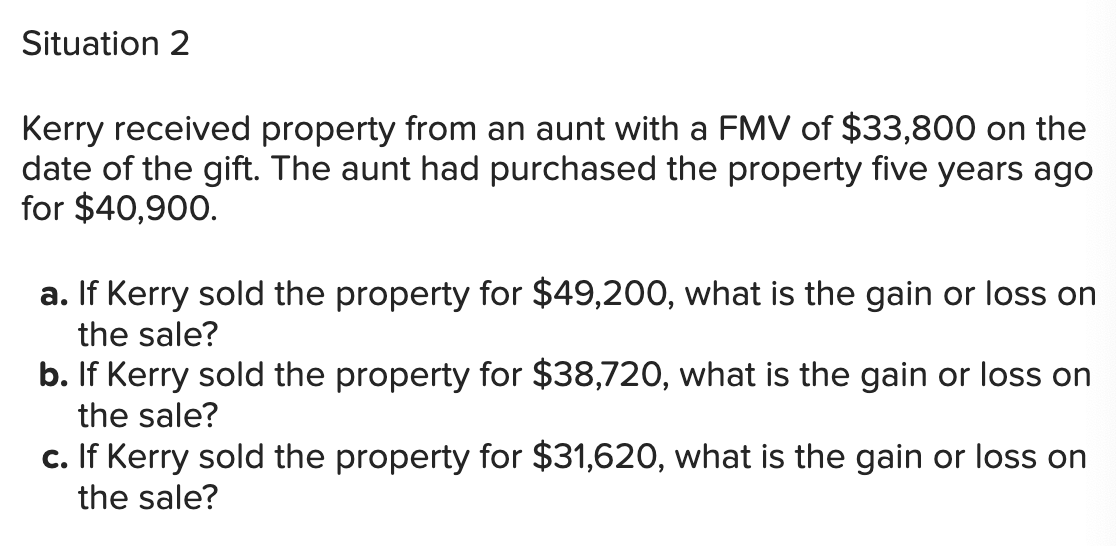

\begin{tabular}{|l|l|} \hline & \multicolumn{1}{|c|}{ Amounts } \\ \hline a. Basis of the property & \\ \hline b. Gain on sale & \\ \hline c. Tax on gain on sale & \\ \hline d. Tax on gain on sale & \\ \hline \end{tabular} Using the following independent situations, answer the following questions: Required: Situation 1 Kerry received property from an aunt with a FMV of $51,400 on the date of the gift. The aunt had purchased the property five years ago for $44,300. Kerry sold the property for $53,500. a. What is the basis to Kerry? b. What is Kerry's gain on the sale? c. If Kerry is in the 37% tax bracket, what is the tax on the gain (assuming there are no other gains or losses to be netted)? d. If Kerry is in the 24% tax bracket, what is the tax on the gain (assuming there are no other gains or losses to be netted)? Kerry received property from an aunt with a FMV of $33,800 on the date of the gift. The aunt had purchased the property five years ago for $40,900. a. If Kerry sold the property for $49,200, what is the gain or loss on the sale? b. If Kerry sold the property for $38,720, what is the gain or loss on the sale? c. If Kerry sold the property for $31,620, what is the gain or loss on the sale? Gain Loss No gain or Loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts