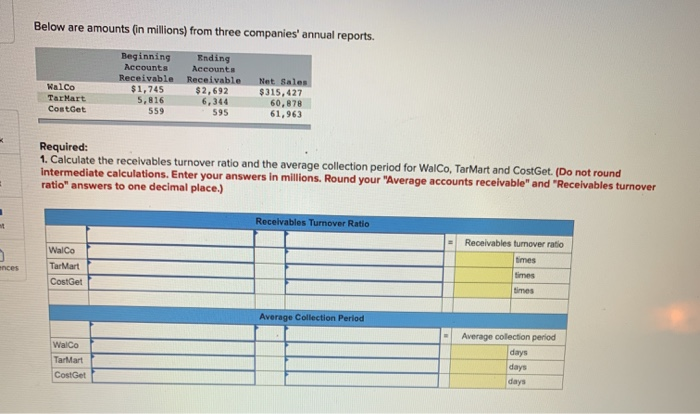

Question: please explain ! :) Below are amounts (in millions) from three companies' annual reports. Beginning Accounts Receivable $1,745 5,816 S59 Ending Accounts Receivable $2,692 6,344

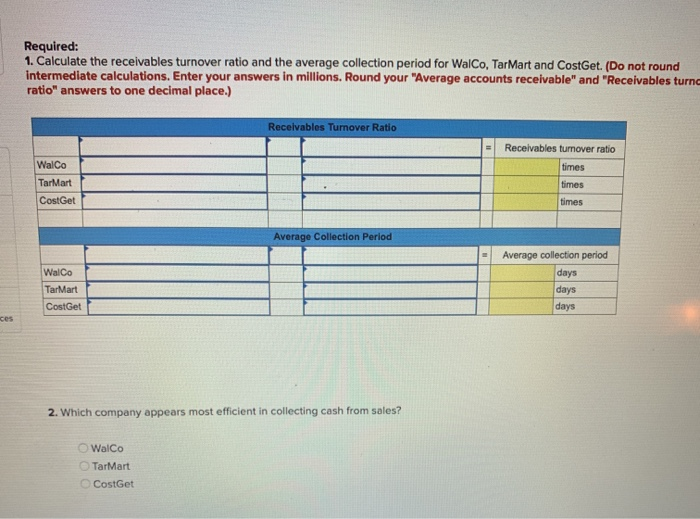

Below are amounts (in millions) from three companies' annual reports. Beginning Accounts Receivable $1,745 5,816 S59 Ending Accounts Receivable $2,692 6,344 595 Walco Tar Mart Costet Net Sales $315,427 60,878 61,963 Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. (Do not round intermediate calculations. Enter your answers in millions. Round your "Average accounts receivable" and "Receivables turnover ratio" answers to one decimal place.) Receivables Turnover Ratio Receivables turnover ratio Walco Tarlar CostGet Average Collection Period Average collection period days days Tartart CostGet das Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. (Do not round Intermediate calculations. Enter your answers in millions. Round your "Average accounts receivable" and "Receivables turn ratio" answers to one decimal place.) Receivables Turnover Ratio = Walco TarMart CostGet Receivables tumover ratio Receivables tumo times times times Average Collection Period - Average collection period Walco TarMart days CostGet days ces 2. Which company appears most efficient in collecting cash from sales? Walco TarMart CostGet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts