Question: Please explain. Bingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750 The cost of the XC-750 is 57 75

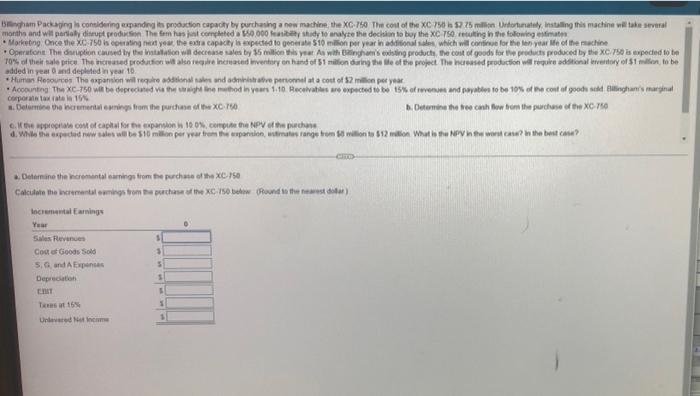

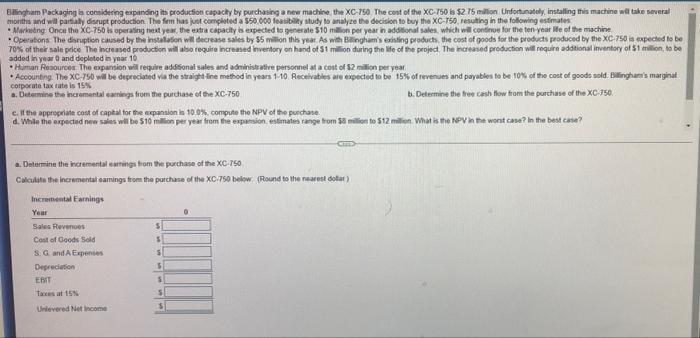

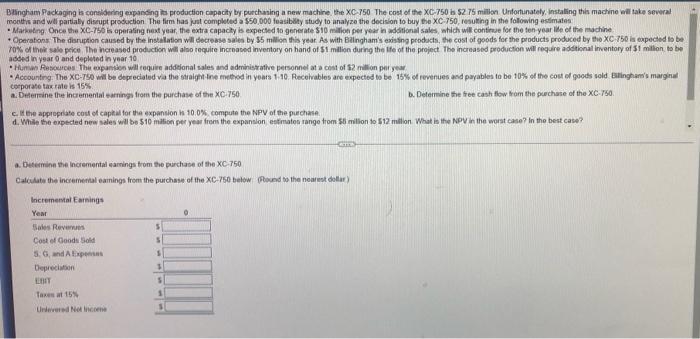

Bingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750 The cost of the XC-750 is 57 75 million Unfortunately, installing this machine will take several months and will partially disrupt production. The fem has just completed a $50,000 feasibety study to analyze the decision to buy the XC-750, resulting in the following estimates Marketing Once the XC-750 is operating next year, the extra capacity is expected to generate $10 million per year in additional sales, which will continue for the len year Me of the machine Operations The disruption caused by the installation will decrease sales by $5 million this year As with Bingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 70% of their sale price. The increased production will also require increased inventory on hand of $1 million during the life of the project. The increased production will require additional inventory of $1 million, to be added in year 0 and depleted in year 10 Human Resources The expansion will require additional sales and administrative personnel at a cost of $2 million per year Accounting The XC-750 will be depreciated via the straight line method in years 1.10. Receivables are expected to be 15% of revenues and payables to be 10% of the cost of goods sold Billinghan's marginal corporate tax rate is 15% b. Determine the free cash flow from the purchase of the XC-750 s. Determine the incremental eamings from the purchase of the XC-750 e. If the appropriate cost of capital for the expansion is 100%, compute the NPV of the purchase d. While the expected new sales will be $10 million per year from the expansion, estimates range from 50 million to $12 million. What is the NPV in the worst case? in the best case? a. Determine the incremental earnings from the purchase of the XC-750 Calculate the incremental eamings from the purchase of the XC-150 below (Round to the nearest dollar) Incremental Earnings Year Sales Revenues Cost of Goods Sold S, G, and A Expenses Depreciation CIT Text 15% Unlevered Not Income 3 S S CITO S 1 Balingham Packaging is considering expanding its production capacity by purchasing a new machine the XC-750 The cost of the XC-750 is $2.75 million Unfortunately, installing this machine will take several months and will partially disrupt production. The firm has just completed a $50,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates Marketing Once the XC-750 is operating next year, the extra capacity is expected to generate $10 million per year in additional sales, which will continue for the ten-year life of the machine Operations. The disruption caused by the installation will decrease sales by $5 million this year As with Billingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 70% of their sale price. The increased production will also require increased inventory on hand of $1 million during the life of the project. The increased production will require additional inventory of $1 million, to be added in year 0 and depleted in year 10 Human Resources The expansion will require additional sales and administrative personnel at a cost of $2 million per year Accounting. The XC-750 will be depreciated via the straight line method in years 1-10 Receivables are expected to be 15% of revenues and payables to be 10% of the cost of goods sold Billingham's marginal corporate tax rate is 15% b. Determine the free cash flow from the purchase of the XC-750 a. Determine the incremental earnings from the purchase of the XC-750 c. If the appropriate cost of capital for the expansion is 10.0%, compute the NPV of the purchase. d. While the expected new sales will be $10 million per year from the expansion, estimates range from $8 million to $12 million. What is the NPV in the worst case? In the best case? a. Determine the incremental earnings from the purchase of the XC-750 Calculate the incremental eamings from the purchase of the XC-750 below. (Round to the nearest dollar) Incremental Earnings Year Sales Revenues Cost of Goods Sold S. G. and A Expenses Depreciation EBIT Taxes at 15% Unlevered Net Income $ S $ 15 CED S S Billingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750 The cost of the XC-750 is $2 75 million. Unfortunately, installing this machine will take several months and will partially disrupt production. The firm has just completed a $50,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates Marketing Once the XC-750 is operating next year, the extra capacity is expected to generate $10 million per year in additional sales, which will continue for the ten-year life of the machine Operations. The disruption caused by the installation will decrease sales by $5 million this year. As with Balingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 70% of their sale price. The increased production will also require increased inventory on hand of $1 million during the life of the project. The increased production will require additional inventory of $1 million to be added in year 0 and depleted in year 10 *Human Resources The expansion will require additional sales and administrative personnel at a cost of $2 million per year Accounting. The XC-750 will be depreciated via the straight-line method in years 1-10. Receivables are expected to be 15% of revenues and payables to be 10% of the cost of goods sold Billingham's marginal corporate tax rate is 15% b. Determine the free cash flow from the purchase of the XC-750 a. Determine the incremental earnings from the purchase of the XC-750 c. If the appropriate cost of capital for the expansion is 10.0%, compute the NPV of the purchase. d. While the expected new sales will be $10 million per year from the expansion estimates range from $5 million to $12 million What is the NPV in the worst case? In the best case? a. Determine the incremental earings from the purchase of the XC-750 Calculate the incremental earings from the purchase of the XC-750 below (Round to the nearest dollar) Incremental Earnings Year Sales Revenues Cost of Goods Sold 5. G, and A Expenses Depreciation EBIT Taxes at 15% Undevered Not Income S S $ S Com 0 Done ngham Package muuta may 2 What is gyes the capity to expect tha matatation by production is C-5d the stage the p 10.0% the mal angegeven just a g the suming the purchase XC-700 umquant ang anv slunumo pramoncin [ [ alsory of 51 min bodies 2 the NPV o Hugtm somuanja van my (25 image001.png h of goods to the products do XC9% The name of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts