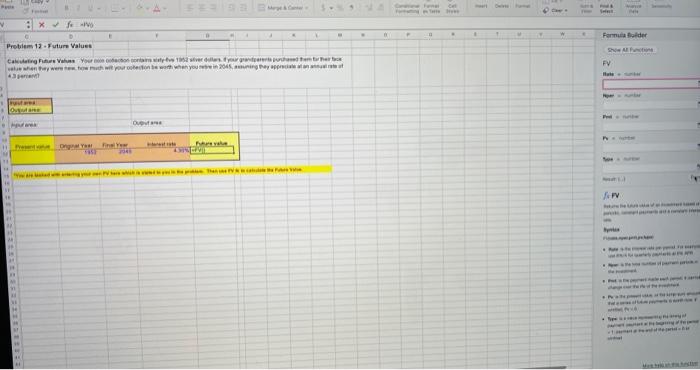

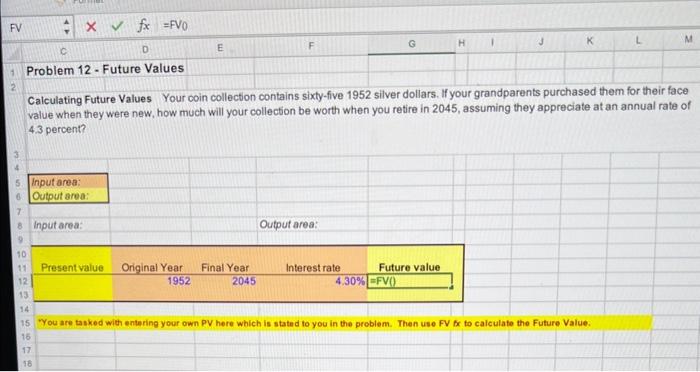

Question: please explain by inserting it numbers into the formula bar if possible Calculating Future Values Your coin collection contains sixty-five 1952 silver dollars. If your

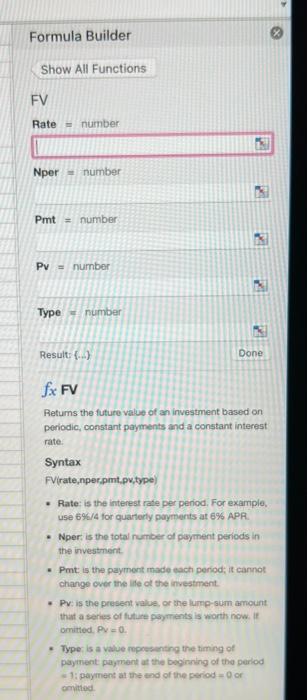

Calculating Future Values Your coin collection contains sixty-five 1952 silver dollars. If your grandparents purchased them for their face value when they were new, how much will your collection be worth when you retire in 2045 , assuming they appreciate at an annual rate of 4.3 percent? Input area: Output area: input area: Output area: +you are tasked with entering your own PY here which is stated to you in the problem. Then use FV fo to calculafe the Future Value. fxFV Returns the future value of an investment based on periodic, constant payments and a constant interest rate. Syntax FV(rate,nper.pmt,pv,type) - Rate: is the interest rate per period, For example, use 6%/4 for quarterly payments at 6% APF. - Nper is the fotal number of payment periods in the invesiment. - Pmt: is the payment made each period; it cannot change over the life of the investment. - Pvi is the present value, or the lump-sum amount that a serhes of future psyments is worth now. if omitted. PV=0. - Typer is a value ropesesting the timing of payment: payment at the beginning of the geriod i: 1: payment at the end of the period =0 or omithod. Calculating Future Values Your coin collection contains sixty-five 1952 silver dollars. If your grandparents purchased them for their face value when they were new, how much will your collection be worth when you retire in 2045 , assuming they appreciate at an annual rate of 4.3 percent? Input area: Output area: input area: Output area: +you are tasked with entering your own PY here which is stated to you in the problem. Then use FV fo to calculafe the Future Value. fxFV Returns the future value of an investment based on periodic, constant payments and a constant interest rate. Syntax FV(rate,nper.pmt,pv,type) - Rate: is the interest rate per period, For example, use 6%/4 for quarterly payments at 6% APF. - Nper is the fotal number of payment periods in the invesiment. - Pmt: is the payment made each period; it cannot change over the life of the investment. - Pvi is the present value, or the lump-sum amount that a serhes of future psyments is worth now. if omitted. PV=0. - Typer is a value ropesesting the timing of payment: payment at the beginning of the geriod i: 1: payment at the end of the period =0 or omithod

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts