Question: PLEASE EXPLAIN CALCULATIONS STEP BY STEP IN EASY WAY b. Default risk: An auto parts company issues a 1-year zero coupon bond with face value

PLEASE EXPLAIN CALCULATIONS STEP BY STEP IN EASY WAY

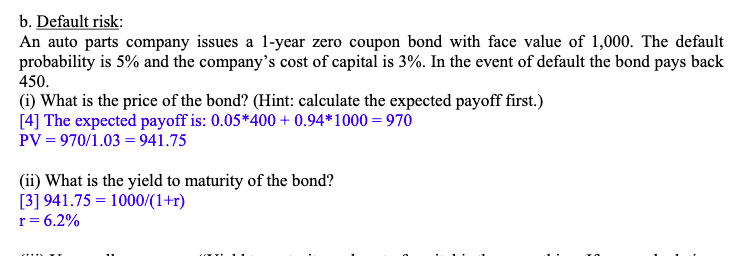

b. Default risk: An auto parts company issues a 1-year zero coupon bond with face value of 1,000. The default probability is 5% and the company's cost of capital is 3%. In the event of default the bond pays back 450. (1) What is the price of the bond? (Hint: calculate the expected payoff first.) [4] The expected payoff is: 0.05*400 +0.94*1000 = 970 PV = 970/1.03 = 941.75 (ii) What is the yield to maturity of the bond? [3] 941.75 = 1000/(1+r) r= 6.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts