Question: please explain CHALLEN PROBLEM What is the coupon rate on a bond that has a current yield of 6.1% a yield to maturity of 7.1%,

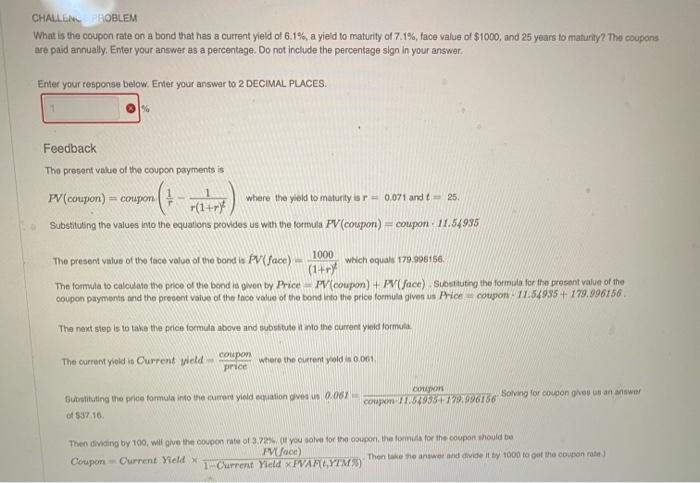

CHALLEN PROBLEM What is the coupon rate on a bond that has a current yield of 6.1% a yield to maturity of 7.1%, face value of $1000, and 25 years to maturity? The coupons ure paid annually. Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your response below. Enter your answer to 2 DECIMAL PLACES, % Feedback The present value of the coupon payments is PV(coupon) - coupon 1 where the yield to maturityisr= 0.071 and 25 +(1+ry Substituting the values into the equations provides us with the formula PV(coupon) = coupon 11.54935 ) The present value of the face value of the bond is PV (face) 1000 which equals 179.996156 (1+ry The formula to calculate the price of the bond is given by Price PV(coupon) PV face) Substituting the formula for the present value of the coupon payments and the present value of the face value of the bond into the price formula given us Price coupon 11.54935+ 179.996156 The next step is to take the price formula above and subuntut into the current le formula The current yield in Current Weld coupon price where the current yolds 0.001 Substituting the price formula into the current yoldation gives us 0.067 of $3710 Coupon Solving for coupon gives us answer coupon 1.629337179096166 Then dividing by 100, will give the coupon rate of 3.72 you solve for the coupon, the form for the coupont should be Coupon Current Yield face) 1- Current Yield PVAFLYTM Then take the awer and divide it ty 1000 to get the coupon rate)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts