Question: Please explain clearly as I do not have prior knowledge of differentiation. Thank you! 26. Consider a mean-variance investor with risk-aversion parameter . A risky

Please explain clearly as I do not have prior knowledge of differentiation. Thank you!

Please explain clearly as I do not have prior knowledge of differentiation. Thank you!

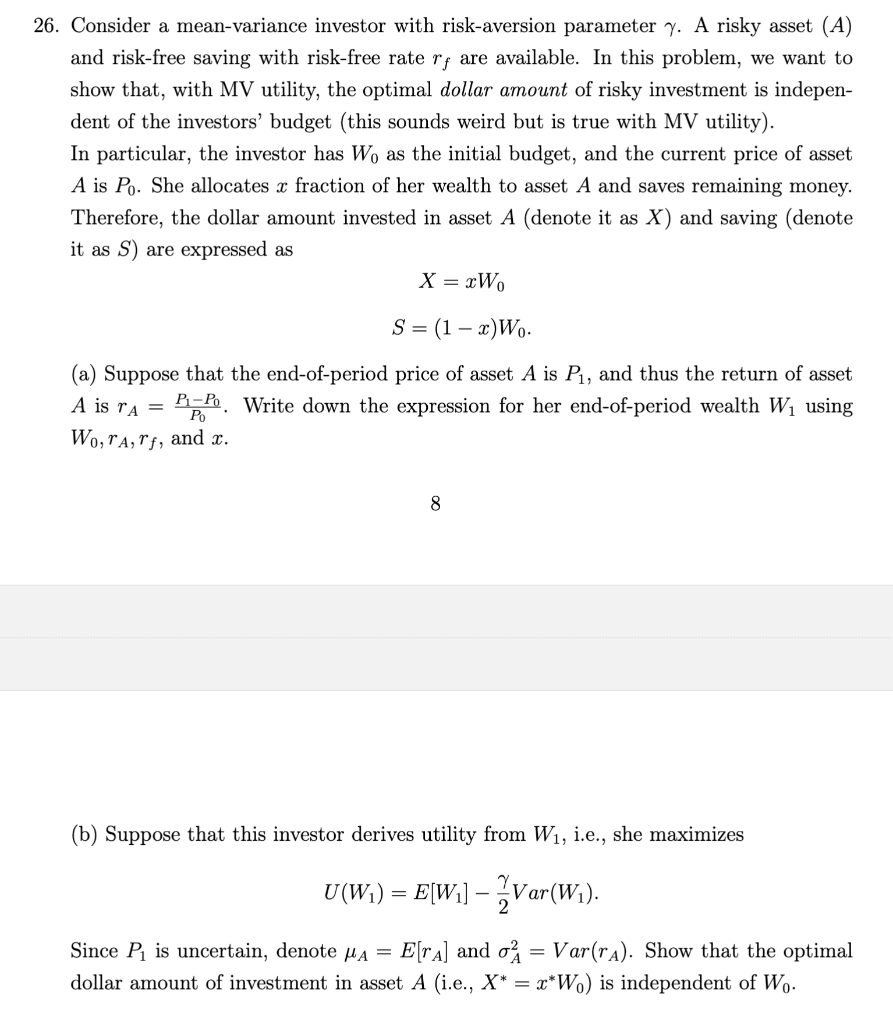

26. Consider a mean-variance investor with risk-aversion parameter . A risky asset (A) and risk-free saving with risk-free rate rf are available. In this problem, we want to show that, with MV utility, the optimal dollar amount of risky investment is independent of the investors' budget (this sounds weird but is true with MV utility). In particular, the investor has W0 as the initial budget, and the current price of asset A is P0. She allocates x fraction of her wealth to asset A and saves remaining money. Therefore, the dollar amount invested in asset A (denote it as X ) and saving (denote it as S ) are expressed as X=xW0S=(1x)W0. (a) Suppose that the end-of-period price of asset A is P1, and thus the return of asset A is rA=P0P1P0. Write down the expression for her end-of-period wealth W1 using W0,rA,rf, and x. 8 (b) Suppose that this investor derives utility from W1, i.e., she maximizes U(W1)=E[W1]2Var(W1) Since P1 is uncertain, denote A=E[rA] and A2=Var(rA). Show that the optimal dollar amount of investment in asset A (i.e., X=xW0 ) is independent of W0. 26. Consider a mean-variance investor with risk-aversion parameter . A risky asset (A) and risk-free saving with risk-free rate rf are available. In this problem, we want to show that, with MV utility, the optimal dollar amount of risky investment is independent of the investors' budget (this sounds weird but is true with MV utility). In particular, the investor has W0 as the initial budget, and the current price of asset A is P0. She allocates x fraction of her wealth to asset A and saves remaining money. Therefore, the dollar amount invested in asset A (denote it as X ) and saving (denote it as S ) are expressed as X=xW0S=(1x)W0. (a) Suppose that the end-of-period price of asset A is P1, and thus the return of asset A is rA=P0P1P0. Write down the expression for her end-of-period wealth W1 using W0,rA,rf, and x. 8 (b) Suppose that this investor derives utility from W1, i.e., she maximizes U(W1)=E[W1]2Var(W1) Since P1 is uncertain, denote A=E[rA] and A2=Var(rA). Show that the optimal dollar amount of investment in asset A (i.e., X=xW0 ) is independent of W0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts