Question: Please explain clearly. Thank you so much!! QUESTION 2 A pension fund is investing $60 million in a well-diversified equity portfolio E and $30 million

Please explain clearly. Thank you so much!!

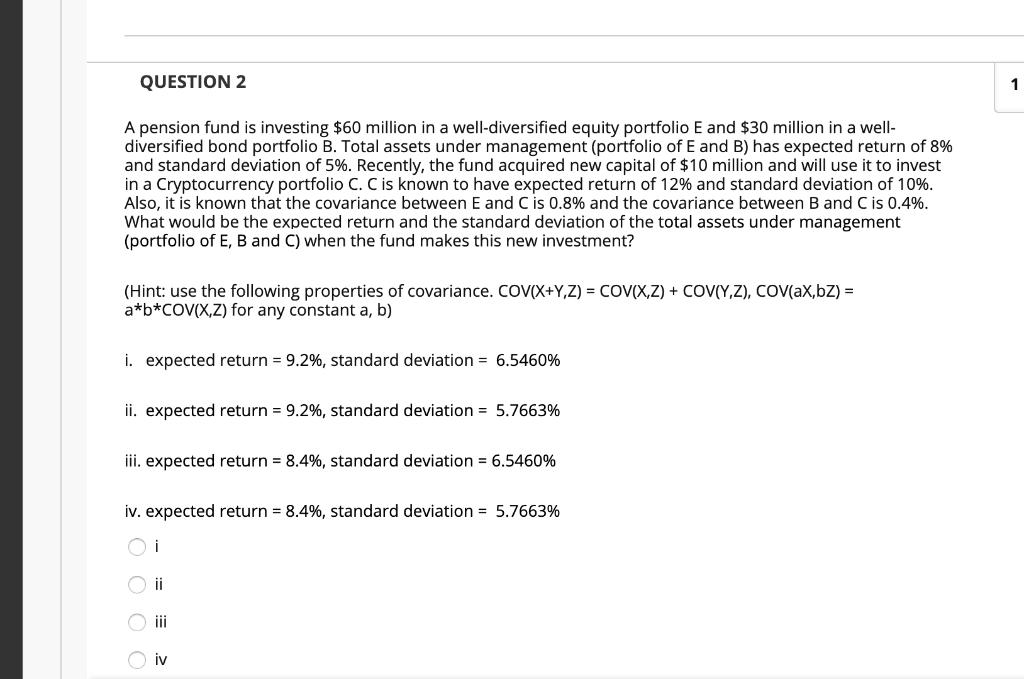

QUESTION 2 A pension fund is investing $60 million in a well-diversified equity portfolio E and $30 million in a well- diversified bond portfolio B. Total assets under management (portfolio of E and B) has expected return of 8% and standard deviation of 5%. Recently, the fund acquired new capital of $10 million and will use it to invest in a Cryptocurrency portfolio C. C is known to have expected return of 12% and standard deviation of 10%. Also, it is known that the covariance between E and C is 0.8% and the covariance between B and C is 0.4%. What would be the expected return and the standard deviation of the total assets under management (portfolio of E, B and C) when the fund makes this new investment? (Hint: use the following properties of covariance. COV(X+Y,Z) = COV(X,Z) + COV(Y,Z), COV(aX,bZ) = a*b*COV(X,Z) for any constant a, b) i. expected return = 9.2%, standard deviation = 6.5460% ii. expected return = 9.2%, standard deviation = 5.7663% iii. expected return = 8.4%, standard deviation = 6.5460% iv. expected return = 8.4%, standard deviation = 5.7663% O o O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts