Question: Please explain completely as to what and why you got your answers. Thank you!! 47. LO.3 Fred is an investor in vacant land. When he

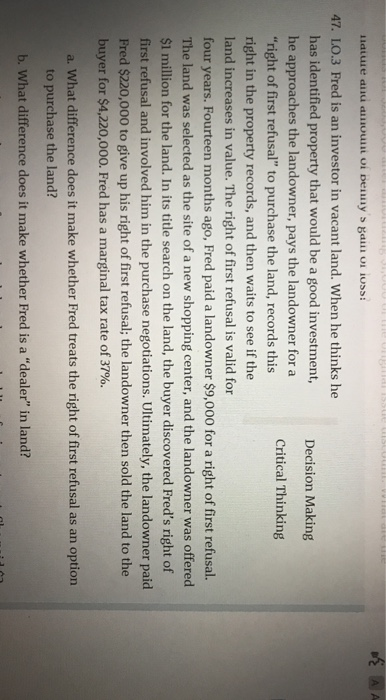

47. LO.3 Fred is an investor in vacant land. When he thinks he has identified property that would be a good investment, he approaches the landowner, pays the landowner for a "right of first refusal" to purchase the land, records this right in the property records, and then waits to see if the land increases in value. The right of first refusal is valid for four years. Fourteen months ago, Fred paid a landowner $9,000 for a right of first refusal. The land was selected as the site of a new shopping center, and the landowner was offered $1 million for the land. In its title search on the land, the buyer discovered Fred's right of first refusal and involved him in the purchase negotiations. Ultimately, the landowner paid Fred $220,000 to give up his right of first refusal; the landowner then sold the land to the buyer for $4,220,000. Fred has a marginal tax rate of 37%. Decision Making Critical Thinking a. What difference does it make whether Fred treats the right of first refusal as an option to purchase the land? b. What difference does it make whether Fred is a "dealer" in land

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts